19 May 2025

The Victorian Government releases the 2025 State Budget tomorrow.

Since 2014 there have been 29 new or increased taxes that specifically relate to the property sector in Victoria. These taxes have distorted the market, impacted purchasing and investment decisions, impeded productivity and more recently deterred investment into Victoria.

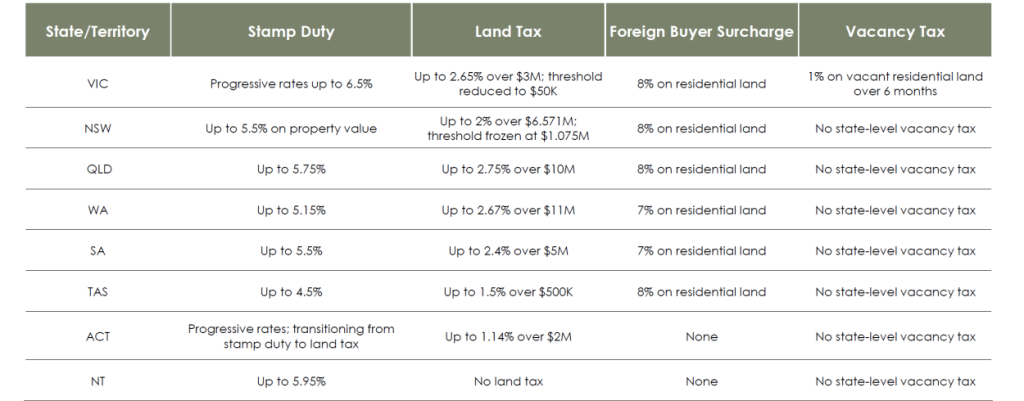

The table below shows that Victoria is now the highest taxed State when it comes to property taxes in Australia.

State & Territory Comparisons

Victoria is now the highest taxed State or Territory in Australia for property taxes.

Source: 2024-2025 State Budget Papers, State Revenue Office Victoria, Revenue NSW, Qld Revenue Office, WA Government, Revenue SA, State Revenue Office Tasmania, ACT Revenue Office, Territory Office ABS, Charter Keck Cramer.

A deeper dive into the tax revenue raised by the Victorian State Government shows that 46% of it comes from taxes on the property industry. This is much higher than some of our neighbouring states (NSW is 44% whilst QLD is 37%).

What is particularly concerning is the level of debt that the state has also accumulated since the pandemic. We are constantly hearing from investors that they are attracted to Victoria but are not investing because of the higher taxes and charges and now the greater levels of sovereign risk when compared to other states and territories.

The Victorian Government is advised to carefully consider its next steps. The “new” housing market has all but collapsed since late 2024 and will take time and Government support at all levels to recover.

Many of the tax policies and changes implemented by the State Government to date have been reactive and regressive. They appear to be based on the assumption that property prices will keep rising and that developers and investors can afford these taxes.

A more proactive and progressive way to address this crisis would be to decrease several of these taxes and charges, reduce red tape, streamline regulations and create more business and investment-friendly settings in a concerted effort to grow the economy. This will encourage innovation, investment and business expansion and will boost productivity and ultimately grow GDP. This in turn will increase Government revenues and reduce the budget deficit in a much more sustainable way without placing unnecessary and unfair financial strain on businesses and individuals.

Melbourne was once the most liveable city in the world. It is possible for the city to regain this mantle, but it starts with the Government taking a progressive longer-term vision with a focus on creating a sustainable path to fiscal stability rather than the current regressive and reactive approach to revenue raising.

Richard Temlett

National Executive Director | Research