As featured in Australian Financial Review

9 September 2025

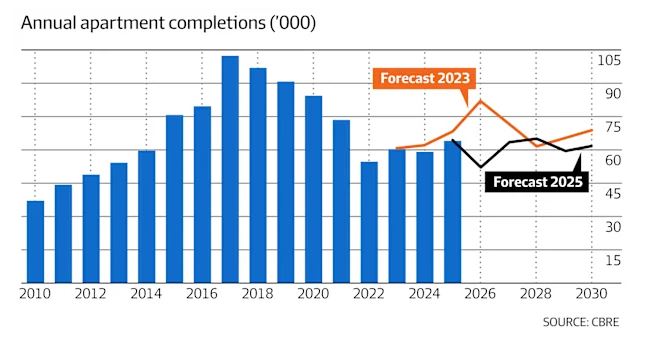

Australia will deliver 30,000 fewer apartments this year than previously expected as developers hold off on projects they couldn’t sell profitably and weak presales and weather delay construction, CBRE says in a new report.

The number of new apartment completions will drop from 64,031 last calendar year to 52,505 – well below the 81,880 homes the commercial real estate agency forecast two years ago.

“It’s because feasibilities didn’t stack up a year or two ago and projects are running slightly behind schedule,” CBRE head of Pacific research Sameer Chopra told The Australian Financial Review.

Including the expected decline next year, new completions over the five years to 2030 were likely to be down 50,000 from 2023 forecast, reflecting in large part the disparity between build cost and sale price, Chopra said.

“Even now, feasibilities are still about 20 per cent under water,” he said.

In the middle of an affordability crisis, the traditional triggers of supply and demand are failing to stimulate more housing development in Australia’s market-led system because it costs more to build new homes than people can afford to pay for them.

The white-hot construction cost growth of the post-COVID 19 pandemic period was over and prices were now again rising faster than costs, but not quickly enough to make planned projects feasible again, Chopra said.

“Prices are growing 2-3 per cent faster than construction,” he said. “It’s closing the gap but needs a more material closure quickly.”

In response, all parties linked to development – including developers and financiers – had to be willing to compromise to get new projects moving, said consultancy Charter Keck Cramer’s national executive director of research Richard Temlett.

“If you are pointing to a balanced market, before the pandemic and using the same risk matrices and viewing the market as back then – we’re not in that market right now,” Temlett said. “We need to make trade-offs and compromise.”

Necessary compromises included governments and authorities being willing to accept lower tax payments or to defer them, and regulators such as bank watchdog APRA had to be willing to loosen prudential requirements such as the 3 percentage buffer used to assess credit applications, he said.

But they also included a requirement for developers of what Charter Keck Cramer calculated were some 67,000 apartments to put more equity into projects to allow construction to begin even with less than the traditional 75 per cent of presales required to unlock finance, Temlett said.

Financiers had to be willing to accept a return below the traditional 20 per cent margin, he said.

“Arguably the correct lens for the current point in the cycle is for the private sector to consider making trade-offs with respect to project returns, risk allocation and apartment pre-sales requirements,” he said.

Sydney accounted for 25,353 of the 67,000 apartments that were launched and still in marketing or under construction with unsold stock, Victoria was second with 15,847 apartments and Gold Coast third with 9351, he said.

Developers that started building earlier would benefit from having completed stock to sell in three years’ time, when pricing power would be stronger and there would still be a lack of apartments, Temlett said.

And in a market where many potential buyers remained wary about whether a promised development project would go ahead, sales of units in projects under construction were typically faster than presales, Urbis national housing sector lead Mark Dawson said.

“Amid all the news of challenging construction, perhaps this is a logical sign of the times, where buyers are being sold confidence that the project will complete within a predictable timeframe,” Dawson said.