29 November 2023

In response to the housing crisis in Australia, the Federal Government is seeking to deliver 1.2M new dwellings (240K p.a.) over the 5 years from 2024 through the National Housing Accord. In addition, and in separate announcements, the NSW Government is seeking to deliver 750,000 new dwellings (75K p.a.) over the next decade, whilst the Victorian Government is seeking to deliver 800,000 new dwellings (80K p.a.) also over the next decade.

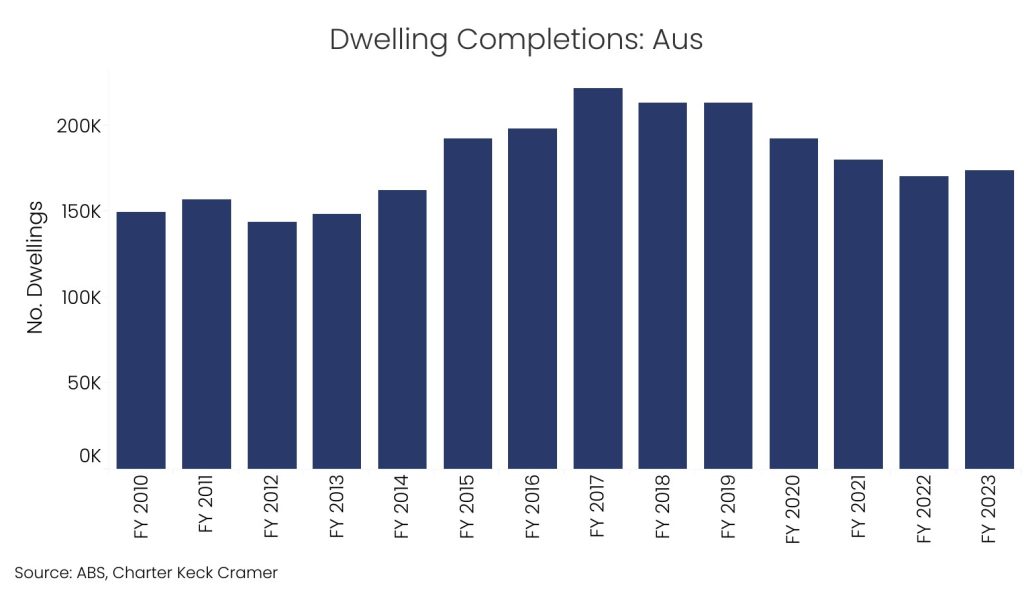

Charter Keck Cramer has studied the new housing markets across Australia to understand how these housing targets compare to historical completions. At peak years of supply, Australia completed just under 220,000 dwellings (in FY2017). Whilst not shown in the chart below, NSW completed 73,000 dwellings (in FY2018) and Victoria completed 67,000 dwellings (in FY2017) respectively.

The targets set by both the Federal and State Governments, whilst admirable and certainly more reflective of the underlying demand for housing than past policy commitments, are considered ambitious and somewhat unrealistic having regard to both historic completions, the future supply pipeline and limitations resultant from the current state of the property market.

Quite simply, to achieve these targets, Australian policy makers will need to create the conditions for one of the largest home building cycles since the 1950s and 1960s. To facilitate rapid change, Governments at all levels will collectively need to employ numerous tools to establish preconditions that facilitate feasible delivery of these dwellings. This may include seeking innovative ideas from active overseas residential markets.

This insight seeks to start the conversation about the critical role that the Build to Sell (BTS) and emerging Build to Rent (BTR) apartment markets will need to play to achieve some of these housing aspirations.

How the BTS and BTR apartment markets work

In comparision to the established housing or the greenfield markets (house and land), the BTS apartment market is not well understood by many policy makers. The BTR apartment market is even less understood given it is still emerging as a residential asset class in Australia.

In a typical BTS project, a developer buys a site and then seeks to get planning approval. Once they have planning approval, and when the market conditions are suitable, they will launch the project for sale off the plan (OTP). Once they have enough OTP presales, they will obtain construction funding and build out the project.

In a typical BTR project, a developer buys a site and then seeks to get planning approval. Once they have planning approval, and when the market conditions are suitable, they will obtain construction funding and build out the project. Once completed, the developer or owner will rent out the dwellings and ultimately may look to sell the stabilised income producing asset after several years.

There are key points along the respective BTS and BTR development journey where risks are highest and where Government and policy makers can assist. Some of the key points are at the planning stage, the sales & marketing stage and now as a legacy of the COVID-19 pandemic, the construction stage.

The importance of investors to the BTS and BTR apartment markets

As mentioned above, the BTS apartment market still primarily relies on presales of apartments that are purchased OTP by either investors or owner-occupiers. Charter Keck Cramer’s analysis of the majority of the BTS apartment sub-markets illustrates that investors (foreign, local or interstate) are more likely to buy OTP than owner-occupiers. In many BTS apartment sub-markets across Australia, investors can account for up to three-quarters of all sales in a BTS apartment project, although the range is more typically 50% to 75% of purchasers. This means that in a typical BTS project, over half of all apartments will enter the private rental market whilst the remainder will be owner occupied.

BTR apartment projects, which are purpose-built projects for long-term rent, do not rely on presales of OTP apartments. These projects do need to be financially feasible on completion (from a revenue perspective) to a financier or investor before funding can be provided for the project to proceed. Justification is however required to highlight potential performance based on projected occupancy and returns.

At present, there are a number of major (and sometimes distinct) hurdles that are preventing investment into both the BTS and BTR apartment markets across Australian cities. It is essential for the Federal, State and Local Government decision makers to understand that if the investors are not present in either the BTS or BTR apartment markets, then projects will not get funded and will not get built. This means that no owner-occupiers get new dwellings, and no renters get rental accommodation, nor does the Government get any tax revenue. It’s a lose-lose scenario with devastating consequences for Australian cities.

How many BTS and BTR apartments need to be built each year?

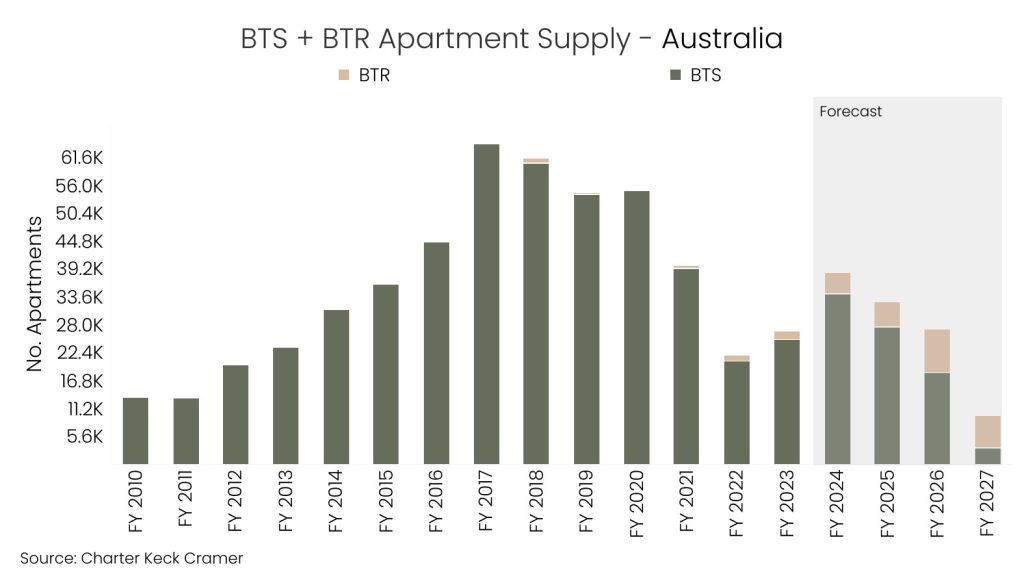

The chart below shows that peak levels of BTS apartments (around 60,000 p.a.) were delivered across Australia over FY2017-FY2020. Policy makers must understand that these peak levels of supply were a function of various settings in place over FY2013-FY2017 that combined and manifested into a significant volume of apartments being constructed over FY2017-FY2020. These included critical settings such as OTP incentives to investors, lower and fewer taxes and charges on buyers and investors, first home buyer grants, greater amounts of investor lending by financiers and lower APRA servicing buffers.

Based on the Federal and State Government targets, Charter Keck Cramer estimates that there will need to be at least 72,000 and closer to 78,000 BTS and BTR apartments completed in Australia each year to hit the various targets. This is a consistent level of supply which requires ongoing settings that are conducive to the feasibility of the BTS and BTR apartment markets and need to be tailored to meet both the housing cycle and overall economic cycle over the next decade.

Where do these BTS and BTR apartment projects need to be built?

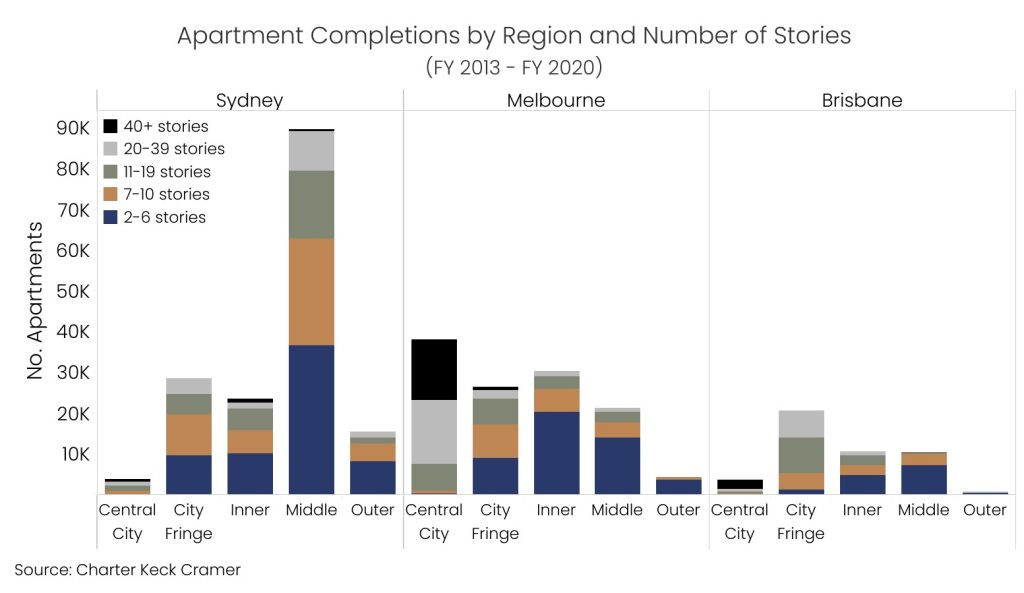

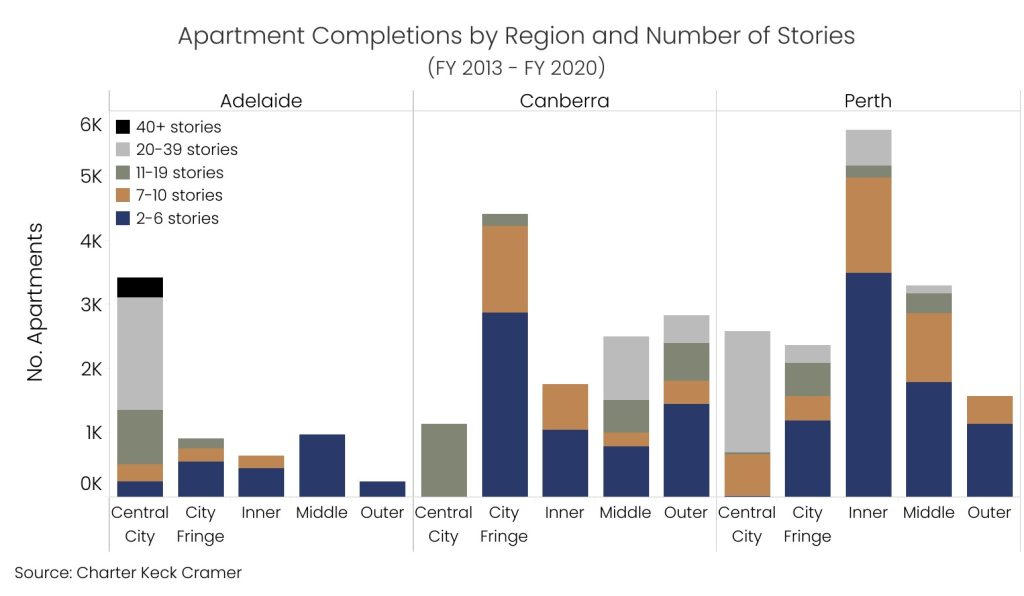

There is a common misconception that all BTS apartments are located in large towers of 10+ levels and that the market is oversupplied. It is this misconception that is likely leading to a fear about density in Australian cities.

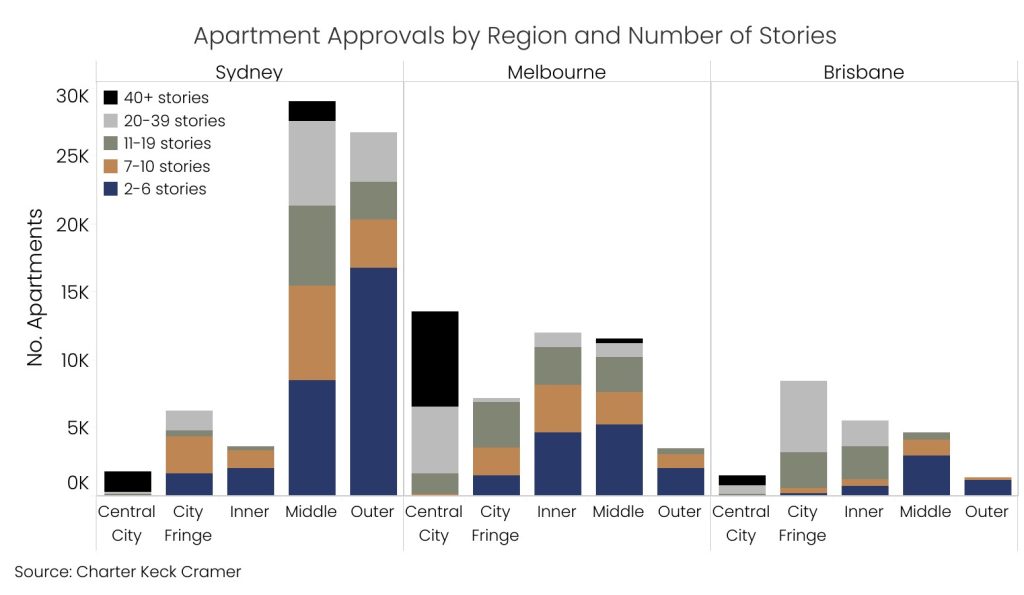

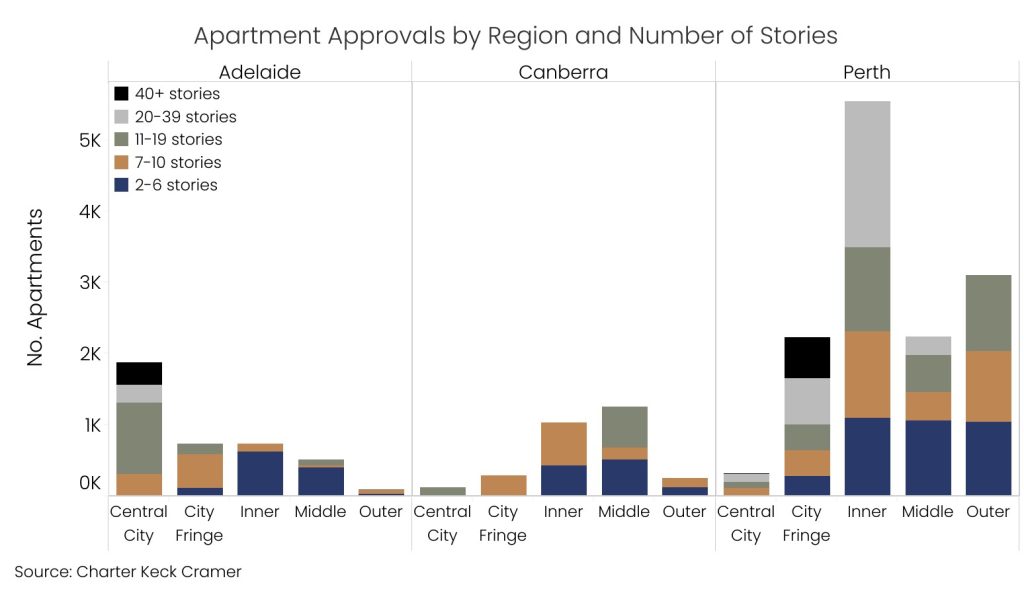

The charts below show the location of BTS apartment supply that was built over the last cycle (FY2013-FY2020) across various cities. We have broken this down by number of stories to illustrate the role that mid-rise projects (2-6 stories) have played in housing Australians.

It is very clear that the BTS apartment markets are active in different regions across different cities in Australia. It is also important to point out that mid-rise BTR apartment development (2-6 stories) accounted for 40% of the total supply across Australian cities. Much of this supply was built in the Inner and Middle regions of these cities often close to existing public transport nodes, employment hubs, retail facilities and lifestyle amenity.

The charts below highlight the location of BTS and BTR apartments with planning approvals within all major national cities. Charter Keck Cramer observes that there are 156,000 apartments that have planning approval (and have been de-risked from a planning perspective) across the various capital cities. Around 53,000 (34%) are in mid-rise projects (2-6 stories) already located in the Inner and Middle regions of the cities.

It is evident that there is an opportunity to create the settings conducive to facilitate the feasible delivery of a number of mid-rise apartment projects along key transport corridors close to amenity and infrastructure across all the cities. Importantly, apartments can be built in and around existing infrastructure and there will be less cost to Government to build when compared against the significantly higher infrastructure requirements in greenfield estates.

What needs to be done to get things moving?

It is our view that the impact of the pandemic on the housing market needs to be viewed through the same lens as was the impact of WW2. Policy makers at all levels of Government need to employ streamlined (and consistent & complementary) policy to assist with the feasible delivery of the supply of dwellings. No single tool, nor single level of Government, can by itself solve the housing crises.

The current various Federal and State housing announcements (whilst still light on key details) are a good start and begin to address the major issues relating to planning constraints, density and delays. These housing statements need to ensure that key current issues are also acknowledged and accounted for as they relate to the sales & marketing and construction stages of the majority of BTS and BTR apartment projects.

Government and APRA should also no longer fear investors. BTS apartment investors (foreign, local and interstate) must be brought back into the market via OTP stamp duty incentives, the removal of various taxes and charges, as well as the expansion of lending to investors. The substantial amount of foreign capital waiting to be invested into BTS and BTR across Australia must be enticed to proceed via further changes to the MIT, land tax, stamp duty as well as changes to GST.

The Australian housing market is at a very different point in the market cycle compared to 2017 (when there was the misinformed perception that the market was going into oversupply and that investors were crowding out owner-occupiers and driving up house prices). Furthermore, the banking sector is also well capitalised and the current APRA settings are arguably not reflective of the current risks in the housing market. APRA needs to remove the serviceability buffer for all borrowers and arguably allow the big banks to revert to various settings back to what they were with respect to investor lending in 2017.

Policy makers must appreciate that projects must be feasible to proceed. Neither developers nor their financiers will proceed with development if they are not able to meet their financial returns (reflective of the risk). With this in mind, it is also evident that all levels of Government need to go further and consider setting up an Apartment Viability Fund, provide rental subsidies for renters, support the construction industry through insolvency moratoriums, consider different types of construction methods such as modular construction and also entice more skilled workers into the country to build out these dwellings.

To conclude, the Government has a social and moral responsibility to facilitate the feasible supply of new dwellings and support the development industry. The supply of new BTS and BTR apartments, which will take 2-4 years to enter the market, will ultimately ease upward pressure on prices and rents, and also create jobs and tax revenue for the Government. Whilst some of these changes and policies will undoubtedly be unpopular with parts of the public, such change is required if the new dwelling targets are to be achieved.

Get in contact with the team!

Richard Temlett | National Executive Director

Brendan Woolley | Director