13 November 2025

Melbourne’s Apartment Market is facing a significant challenge, with around 8,000 unsold apartments built between 2020 and 2024 due to pandemic disruptions and lockdowns. Government-imposed taxes and charges on foreign buyers have further dampened demand, while rising delivery costs mean new apartments in 2025 will need to be priced roughly 30% higher than in 2020. Charter Keck Cramer highlights that targeted government intervention, such as reducing taxes and charges or offering incentives, will be critical to absorb existing stock, stimulate demand, and support the sustainable delivery of new apartments.

In March this year Charter Keck Cramer highlighted that Melbourne's apartment market (Build to Sell) was facing a significant challenge, with 8,000 unsold apartments constructed between 2020 and 2024. This issue stems from the last investor-led cycle, where numerous apartments were presold before the pandemic and subsequently delivered during Melbourne's lockdowns. The lockdowns, combined with movement restrictions and border closures, considerably dampened occupier demand.

Since 2017, and increasingly since 2022, the imposition of additional taxes and charges on foreign buyers of new apartments has further complicated the market dynamics. Despite these obstacles, our research indicates that foreign investors remain highly attracted to "Brand Melbourne." However, the existing foreign taxes and charges are significant deterrents to their investment.

The Outlook

Looking ahead, our research suggests that new apartments in 2025 will need to be priced approximately +30% higher than those in 2020. This price hike is due to the rising costs of delivery, with taxes and charges now comprising 30-40% of the total expense of new apartments. As long as the current stock remains unsold in various sub-markets, it will be challenging to deliver new supply at the necessary 2025 price points.

Both the government and developers are keen to stimulate new apartment supply. Developers are particularly desperate to sell the existing unsold stock to allow the market to recalibrate and support the new pricing structure.

Our position is that government lockdowns have distorted Melbourne's apartment market, and government intervention is essential to resolve this issue.

Impact of Stamp Duty Concessions on Apartment Uptake

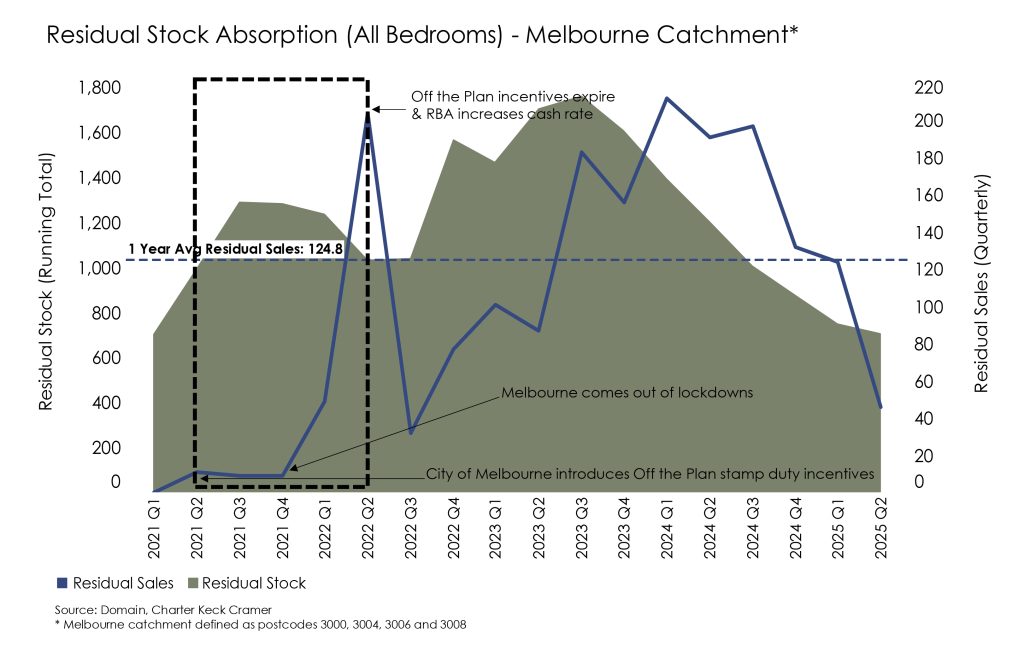

From June 2021 to June 2022, the City of Melbourne Local Government Area introduced stamp duty concessions (or exemptions) for unsold completed apartments. As the chart below shows, this incentive led to a strong uptake of apartments. However, once the incentive was withdrawn, demand dropped off significantly.

It is evident that the government has a pivotal role in reactivating Melbourne's apartment market. By removing one or more of the taxes and charges currently imposed on these apartments, the government can help facilitate their absorption into the market. This approach would be beneficial for all stakeholders, including the government, developers, foreign investors and ultimately occupiers (buyers or renters), as it would act as a catalyst for new supply.

In conclusion, government intervention is crucial to address the unsold apartment stock and support the delivery of new apartments at sustainable price points. Removing the existing taxes and charges would not only stimulate demand but also contribute to the long-term health of Melbourne’s apartment market.

Richard Temlett, National Executive Director | Research