12 December 2023

The post pandemic world is a very different world for commercial property with industrial property emerging as a premier commercial asset providing both security of income and growing value.

Favourable structural change during the COVID and post COVID eras has seen sustained growth in industrial values and rents driven by almost unabated occupier demand.

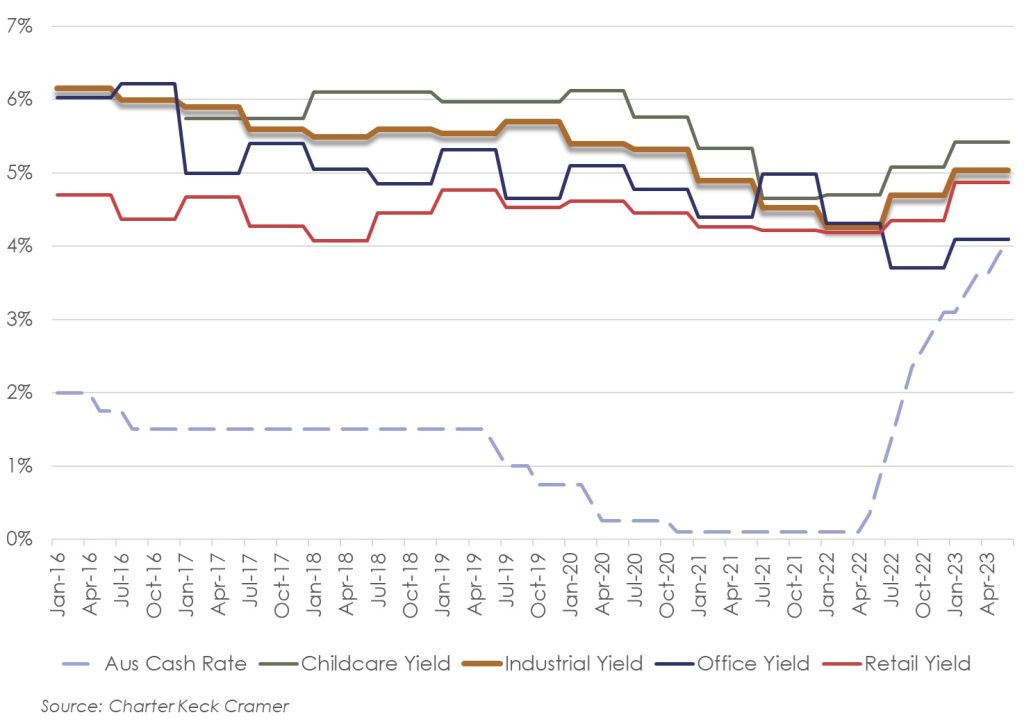

As a result, the performance spread between retail, office and industrial assets increasingly favours industrial assets which over the past five years have demonstrated highly desirable investment traits; value growth, security of income and sustained floor space demand. As we see in the graph below, as industrial values have risen across the nation industrial yields have been very stable owing to ongoing rental growth.

Figure 1: Property Yields by Asset Class Jan 2016 – Jun 2023

The post pandemic commercial world favours industrial

What are the structural changes impacting on industrial demand? We see both mega trends and local factors.

The COVID-19 pandemic expedited and expanded the rise of e-commerce as fundamental to the way in which households purchase and consume merchandise and increasingly food and perishables. Between 2016 and 2023, the proportion of e-commerce to all retail trade increased from 3.6% to 10.7%1. As a point of comparison, the UK’s penetration rate hovered around 10.6% in 2012 – reaching 26.5% by 20222 Ongoing penetration of e-commerce as a component of retail trade is anticipated to continue to grow, albeit at a slower rate than in the previous decade. In response to the need to store and rapidly distribute an increasing array of goods by both pure e-commerce and omni enterprises (mixed online and bricks-and-mortar based enterprises), demand for industrial floor space has grown exponentially.

In Melbourne the epicentre of industrial growth is in Melbourne’s west. In Melbourne’s west flat greenfield land connected to national transport infrastructure and the west’s booming population has seen the development of over 800 hectares of new industrial land since 2017. Melbourne’s west is now home to Victoria’s largest cluster of large format e-commerce and omni enterprises including premium national and international brands.

The freedom and flexibility of industrial settings is attractive to business both big and small. Contemporary industrial business parks provide immense freedom and flexibility including 24-hour settings, worker and guest amenities, security, vibrant hospitality and gathering spaces and mixed and flexible work spaces. The freedom and flexibility of industrial areas means we are seeing the most interesting and innovative businesses emerge in industrial settings – we note that the nation’s leading technological precinct in Cremorne emerged in post-industrial settings.

What does our industrial future look like?

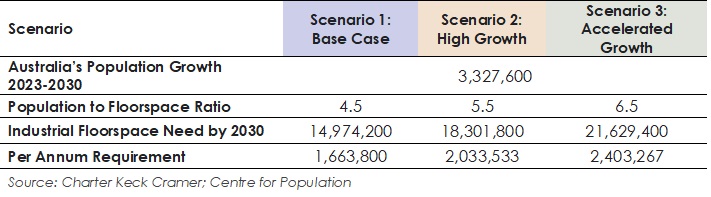

If we think about the continued penetration of e-commerce platforms coupled with the nation’s projected population growth and that we will be a population of 30 million people by 2030, continued demand for industrial and urban service type floor space is guaranteed. If we assume 4.5 sqms of industrial floor space per person the national industrial task is immense. Where all of this space can be delivered particularly in high density locations in our major cities will be a major challenge but also a unique opportunity.

Figure 2: Industrial floorspace need 2023-2030

1 Charter Keck Cramer calculations using the ABS, Retail Trade Australia Dataset.

2 Centre for Retail Studies. (2023). Online Shares for Retail Trade accessed through retailresearch.org.

Get in touch with our team today.

Simon Micmacher | Director, Research

Terry Dwyer | Director, Industrial Valuations