Introduction

The Sydney industrial market has performed excellently since early 2020 and the onset of the COVID-19 pandemic. Lockdowns and a work from home culture have created a boom in e-commerce, with manufacturing, logistics and last mile delivery sectors competing for space already under pressure from ongoing stock withdrawals in city fringe locations.

Vacancy hit a record low of nearly 0% in mid-2023 and is now hovering around circa 2%, well below market equilibrium and historical averages. The Western Sydney Aerotropolis precinct will see the delivery of significant new industrial supply which over time should place downward pressure on rentals however this supply is likely to be absorbed by occupiers who either are serviced by or service the airport itself.

Strong fundamental market dynamics have led to increased industrial rents and capital values, which have flowed out from the metropolitan Sydney basin to wider New South Wales. This has been driven by the well reported record low statewide industrial vacancy rates.

More recently, numerous RBA cash rate increases have put pressure on historically low yields that were witnessed to mid-2022. It is anticipated that 2024 will see further yield expansion as market evidence to date does not seem to fully reflect the circa 425 basis point cash rate rise since May 2022. It is also anticipated that there will be some further rental growth due to demand outweighing supply.

The industrial rental market is anticipated to stabilise in the short term until new stock is introduced to the market and vacancy rates return to a reasonable level. An increase in industrial supply coupled with declining consumer sentiment and spending power add to headwinds for the industrial sector over the medium term outlook.

The industrial markets in metropolitan Sydney are separated into submarkets by geographical location, with some areas performing better than others. Major developments such as the Western Sydney Aerotropolis have been beneficial for surrounding precincts that provide easy access and good linkages. We anticipate demand in the Outer Western Sydney markets to remain strong.

Demand for inner city industrial land has been strong for some time as a number of assets have been converted to residential or creative office/showroom developments which has diminished the supply of industrial land with easy access to the Sydney CBD. More traditional industrial users continue to be outpriced from these locations which have experienced significant rental and capital growth.

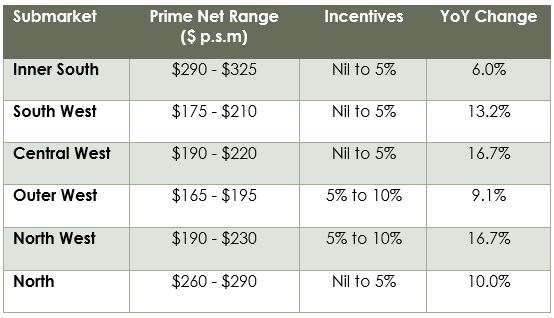

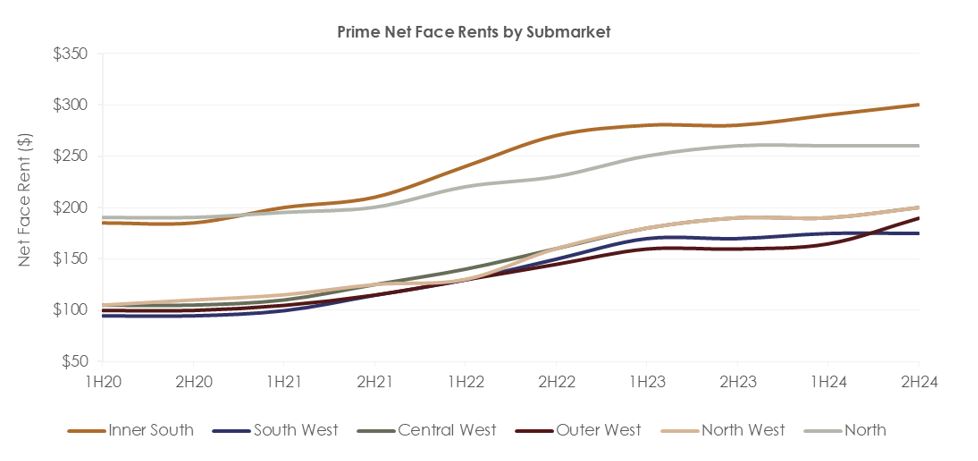

Rents

Sydney’s industrial rental market continues to grow, albeit the rate of growth has softened and in some instances stabilised following rapid rental growth in the post-COVID environment. The shortage of industrial assets across metropolitan Sydney coupled with strength in the e-commerce and logistics industries has translated into extremely low vacancy rates, increased competition and upward pressure on rents.

The secondary industrial rental market has benefitted from the scarcity of prime assets as occupiers have adjusted their expectations and looked further afield in order to secure a tenancy. This has flowed through to rental growth in outer Sydney and regional New South Wales markets. Recent cash rate rises and cost of living pressures have impacted consumer demand which will likely result in decreased demand for the logistics sector. However, a shortage of supply has prevented rental declines to date.

Source: Charter Keck Cramer

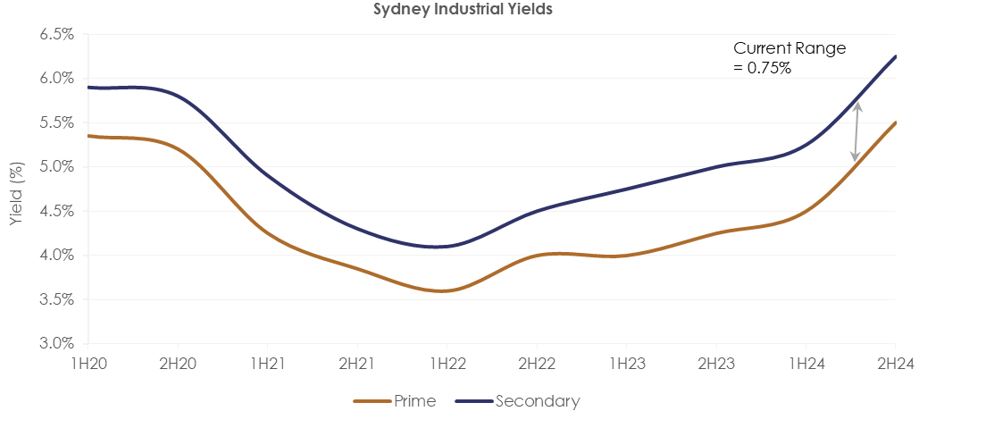

Yields

Industrial yields had been driven to historic lows due to a combination of factors including stock withdrawals for conversion / redevelopment, a significant increase in online purchasing flowing to distribution demand, and consumer spending trends flowing to an increase in demand for manufacturing space.

There have been some indications of softening investment yields in light of the circa 425 basis point cash rate increases since May 2022 and it is anticipated that 2024 will see further yield softening. Yields to date have to some degree masked investor appetite as a number of transactions have reflected substantial positive rental reversions.

The disparity between prime and secondary yields has remained stable since mid-2020 at circa 50 - 75 basis points and has been fuelled by a lack of supply across industrial markets being outstripped by demand coupled with an appetite to redevelop and intensify older developments. Charter Keck Cramer expect the market to price in a larger difference between prime and secondary assets moving forwards, particularly at higher price point investment grade stock. This will likely be skewed by stock with realistic development or reversionary income potential continuing to trade at a relatively low yield when compared to passive investments.

Source: Charter Keck Cramer

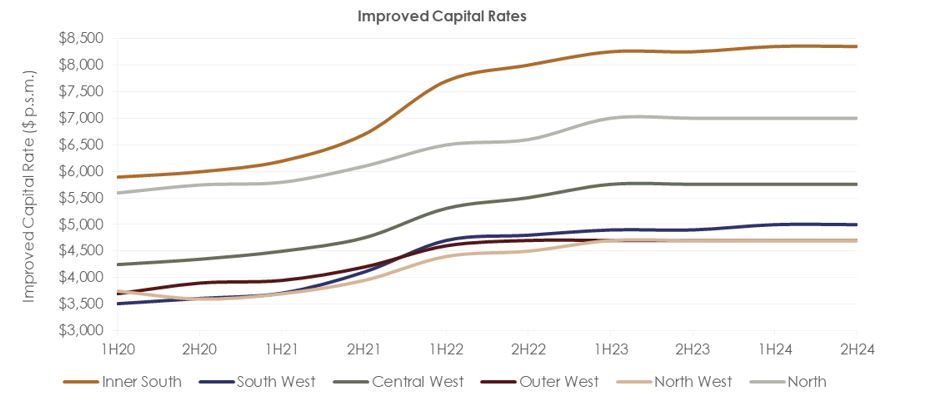

Improved Capital Rates

Unlike most property sectors, improved capital rates for industrial properties have increased since early 2020, although are considered to have peaked. Although all sub-sectors are still showing positive growth, the pace of growth has moderated from the 12 months prior to show single digit growth in all areas.

Unsustainably high growth rates of the recent past are moderating. It is expected that growth will continue to slow with the potential for this to turn negative due to the lagging effect of recent interest rate increases and may limit industrial owner / purchaser ability to service debt. We do however note that rental increases have so far offset the majority of yield softening, and for those properties where passing rent was set prior to COVID, significant rental reversions will likely flow though at the next renewal / market review.

Source: Charter Keck Cramer

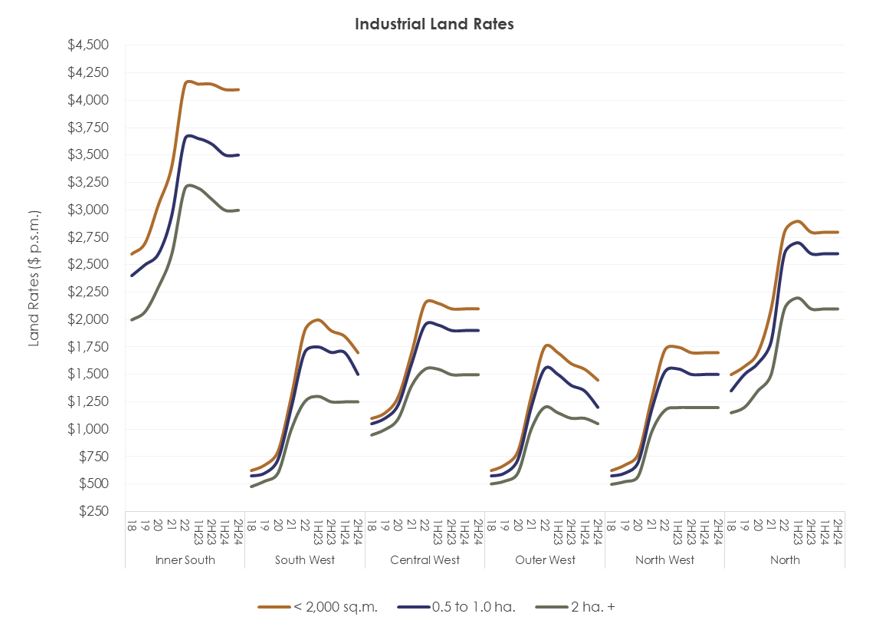

Land Rates

A scarcity of industrial land in metropolitan Sydney, and wider regional New South Wales, has resulted in rapid growth in land prices over the last 3 to 4 years across all industrial markets. The inner south area has seen a significant amount of stock purchased for future redevelopment, often to residential or creative office/showroom. This has driven land value rate increases that have flowed to other locations.

Land value rates are expected to stabilise in the short term as increased build costs and softer yields impact redevelopment viability. Similar to improved capital value rates, all sub-sectors are indicating moderated or nil growth and this trend is expected to continue. The South West, Outer West and North West markets are expected to be affected by significant new land supply in the medium term as a result of the Western Sydney Aerotropolis development and associated land rezonings.

Source: Charter Keck Cramer

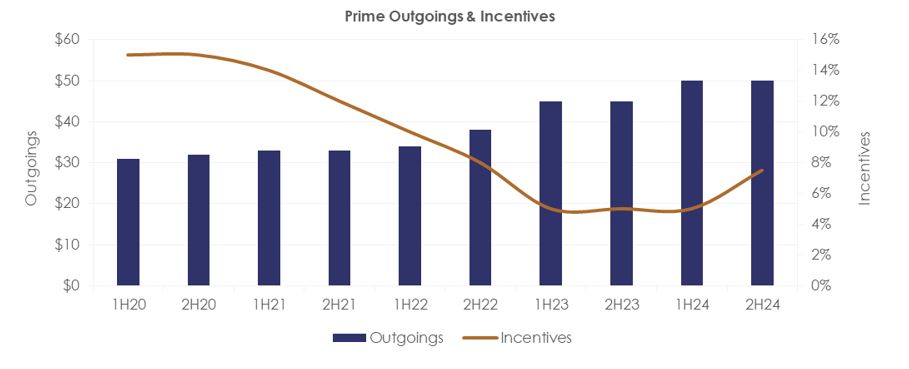

Outgoings & Incentives

Inflationary pressures have increased operational outgoings over the last 24 months. Although operational outgoings are likely to return to more normal growth in the short to medium term, statutory outgoings are anticipated to continue to grow strongly as increased land values will result in higher land tax and Council rates payable in future rating periods.

Due to historically and globally low vacancy rates, incentives being offered in the market have correspondingly declined. Incentives are currently sitting at a five year low of around nil to 10% in most markets and competition for space remains strong.

Source: Charter Keck Cramer

Get in touch with our experts!

Mark Willers - National Director | Valuations - Commercial

Brendan Woolley - Director | Research

Samantha McGrail - Associate Director | Advisory

Jim Paxinos - Associate Director | Valuations - Commercial

Oliver Daniel - Executive | Advisory

This Insight has been carefully prepared by Charter Keck Cramer. This Insight does not render financial or investment advice and neither Charter Keck Cramer nor any persons involved in its preparation accepts any form of liability for its contents. The information contained herein was compiled in October2024 and should not be relied upon to replace professional advice on specific matters. Charter Keck Cramer is not providing advice about the suitability of investment in any specific project or financial product and is not a holder of an Australian Financial Services Licence. This Insight is Copyright and cannot be reproduced without written permission of Charter Keck Cramer.

© 2024 Charter Keck Cramer