27 October 2022

Charter Keck Cramer has consistently observed that Net Overseas Migration (NOM) is a key driver of several housing sub-markets across Australia. This is particularly the case with many apartment sub-markets which still primarily rely on NOM as a key source of occupier (renter and purchaser) demand.

Prior to COVID-19, NOM into Australia as well as both New South Wales (NSW) and Victoria (VIC) was extremely strong. As a result, vacancy rates were low and rents were increasing across many of these apartment sub-markets. COVID-19 caused international borders to close and NOM effectively ceased. The loss of NOM, and hence occupier demand, translated into high vacancies and falling rents in many apartment sub-markets.

Charter Keck Cramer has previously highlighted that one of the biggest risks facing the apartment sub-markets, in terms of how quickly they recover, comes down to the timing and quantum of the return of NOM.

The Federal Government Centre for Population forecasts anticipate that NOM will start to strongly return in FY2023 across most Australian cities. It is also positive to note that at the Jobs and Skills Summit in September 2022 the Federal Government announced an increase to the Permanent Migration Cap for the next 12 months from 160,000 to 195,000 migrants. Both of these considerations have been re-emphasised in this week's Federal Budget for 2022/2023.

A deeper analysis into some of the Australian Bureau of Statistics (ABS) figures shows that migrants are a significant and ongoing source of demand for renting. The statistics show that around 75% of migrants that land in Australia rent before slowly moving into the home ownership market. Furthermore, Charter Keck Cramer observes that migrants also bring with them their living preferences. Given many have lived in higher density apartments overseas, and some even in Build to Rent (BtR), there is no aversion to living and renting apartments.

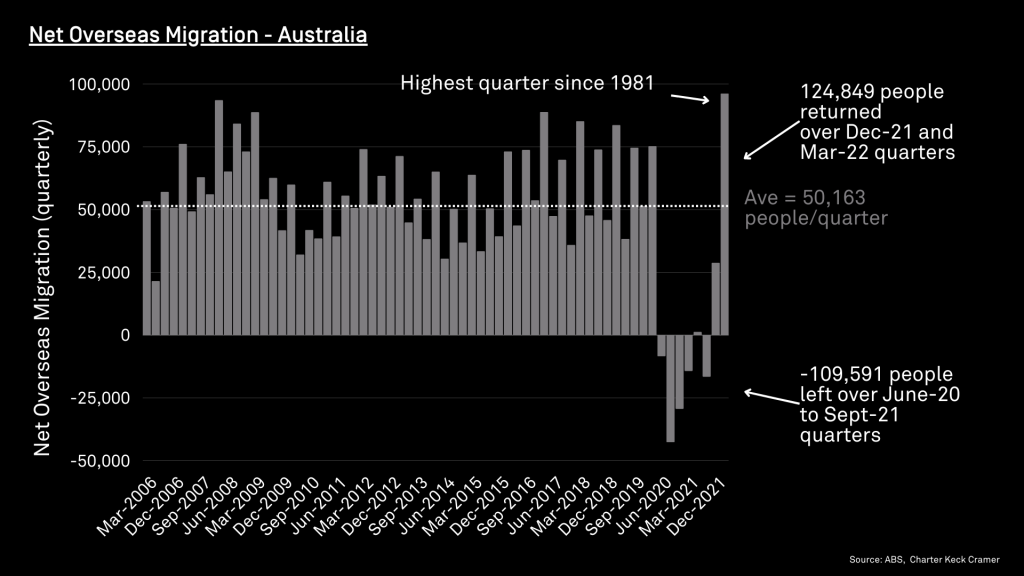

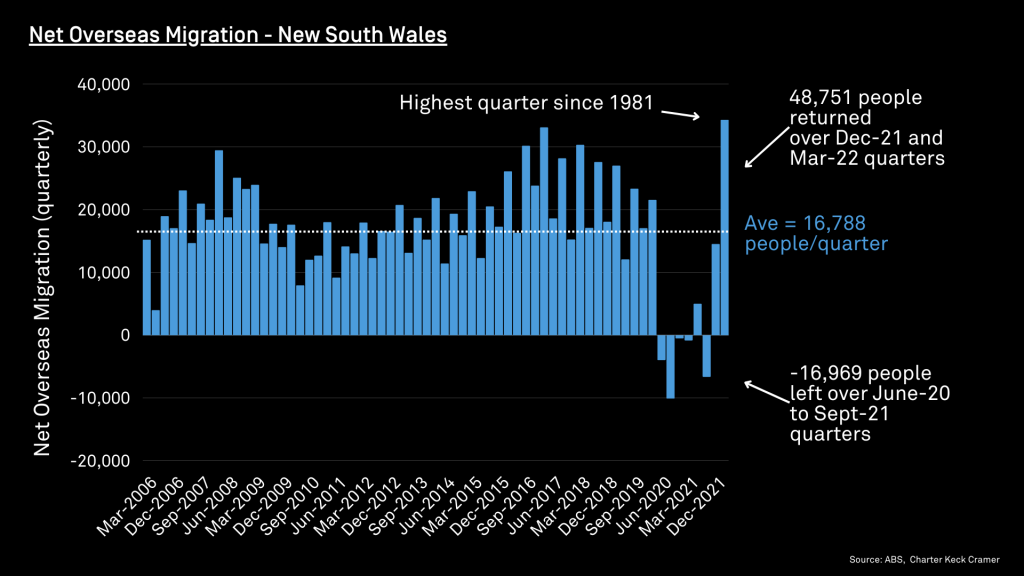

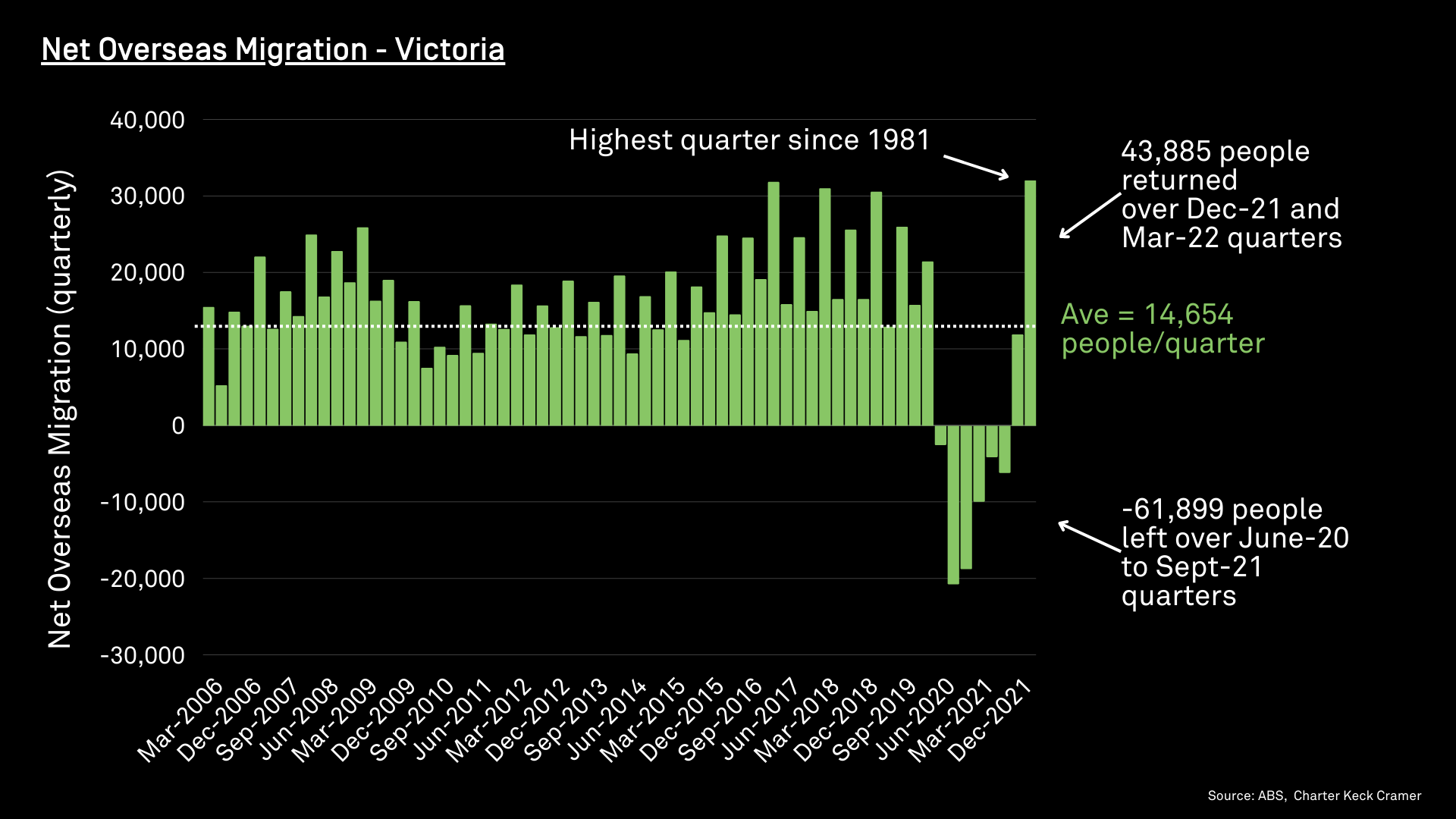

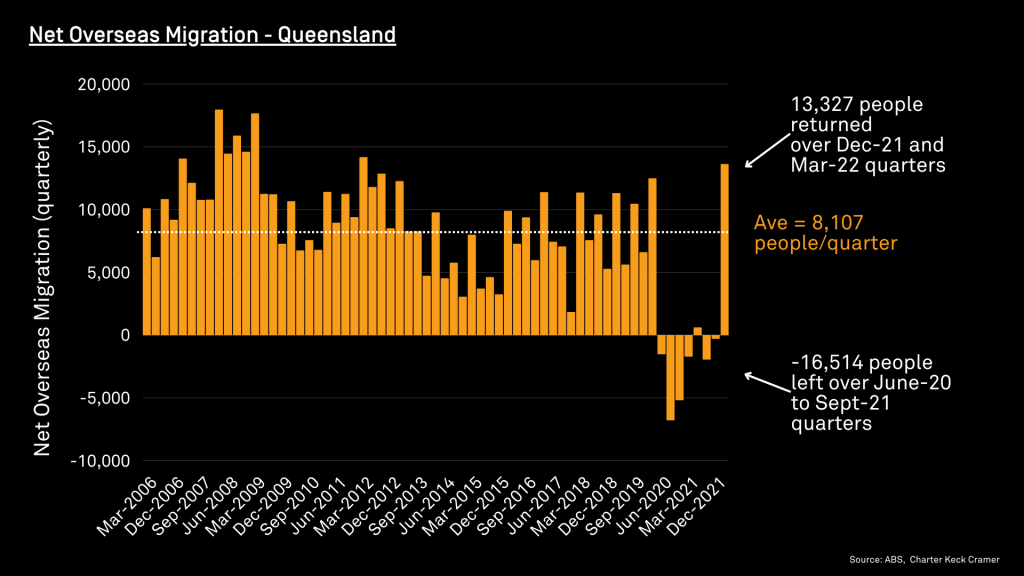

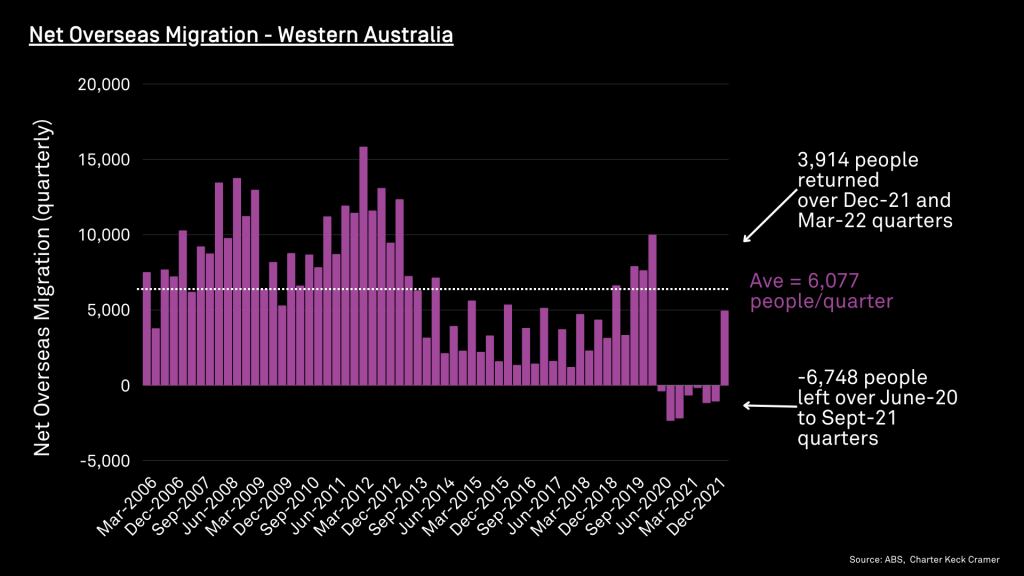

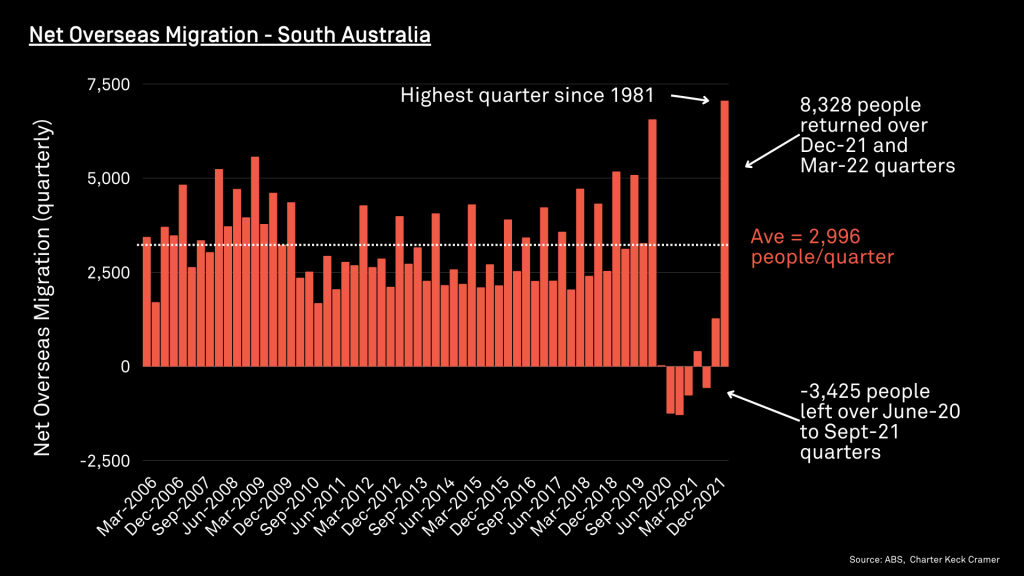

The most recent National, State and Territory population statistics for the period March 2022 (released in September 2022) show that NOM is starting to strongly return. Some of the key findings include:

- Over the peak of COVID-19 (June-20 to Sept-21 quarters) a total of 109,591 people left Australia. Over the last two quarters (Dec-21 and Mar-22) a total of 124,849 people entered Australia. The most recent quarter (Mar-22) was the highest quarter on record (or since 1981).

- NSW and SA. Both of states had negative NOM during the height of COVID-19 but both have seen strong levels of NOM return. In fact, both states have also observed the highest number of NOM ever over their respective Mar-22 quarters. These provide strong tailwinds for the housing (and apartment) markets in these states.

- Still recovering from the impact of 6 lockdowns. A total of 61,899 people left Victoria during the height of COVID-19 and a total of 43,885 have returned over the Dec-21 and Mar-22 quarters. Importantly, NOM over the most recent quarter (Mar-22) was also the highest quarter on record (or since 1981).

- WA and QLD. These states have less of a reliance on NOM and are still making up the numbers lost through the height of the pandemic. Interestingly, NOM is starting to return (particularly to QLD) and is anticipated to play a much greater role in QLD over the next decade in the lead up to the Olympics in 2032.

Charter Keck Cramer anticipates that this high level of NOM is likely to be sustained and in fact may be greater (and return faster) than the Federal and State Government forecasts. Further figures show that student and working visa approvals are rapidly increasing and there has been a substantial surge in visa applications since June 2022. In fact, many of these figures are close to, or already at, pre-pandemic levels.

This increase in demand will drive demand for additional and diverse forms of dwellings. The apartment market is certainly a segment that stands to benefit from this rapid increase in demand. Charter Keck Cramer notes that there is already a shortage of rental dwellings across many Australian cities (which is most easily illustrated in the tight vacancy rates) and has highlighted the impending, and now existing, mismatch between supply and demand in the apartment markets across Sydney, Melbourne and Brisbane. Click here to download the Charter Keck Cramer State of the Markets reports, H1 2022.

On one hand, demand is starting to return much faster than anticipated. On the other, given the issues relating to rising interest rates, increasing construction costs and weak consumer sentiment, supply is continuing to slow down even further. This stands to create significant development and investment opportunities across many apartment sub-markets in Australia.

Get in touch with our Research & Strategy team to see how this can assist with your next project.