19 July 2023

Conditions in the BTS apartment market are arguably the toughest they have ever been.

There is a lot of negative sentiment and general apprehension at present surrounding the apartment markets in Melbourne. It is Charter Keck Cramer’s view that this is not reflective of the entire market, nor is it reflective of everything that we are actually seeing and hearing on the ground, nor what is in fact starting to emerge in the statistics.

The Research team at Charter Keck Cramer has been asked by a number of our clients whether it is possible to increase Build to Sell (BTS) off the plan apartment value rates in their projects in light of the substantial increase in construction costs over 2020-2023. Given the Charter Keck Cramer Research team’s mission is to provide evidence-based and forwarding-looking insights that assist the industry with their development decisions we have investigated this and made some of our views publicly available.

Summary

At the outset, it is acknowledged that conditions in the BTS apartment market are arguably the toughest they have ever been. The market has moved incredibly quickly over the last 12-18 months in light of the volatility and “push and pull” of rapid interest rate rises, the strong return of overseas migration, substantial increase in construction costs and volatile consumer sentiment. These factors are making many apartment projects unfeasible and leading to very slow sales rates. They are also causing rents to increase substantially.

There are however a number of fundamental reasons that support the thesis that off the plan apartment value rates across the entire apartment market in Melbourne will simply have to recalibrate upwards over the next 12 months. In fact, our analysis of apartment projects across 10 suburbs in Melbourne shows that several of those that have been released over 2023 have increased their off the plan value rates by +15% to +25% (compared to pre-COVID off the plan value rates of apartments of the same size in earlier stages of the same development or in comparable projects in the same locations) and these projects are being met with market acceptance (albeit still slowly).

We emphasise however, that whilst this is just starting to occur, it is not yet possible for every project in every location to revise off the plan value rates upwards. At present, the ability to increase value rates comes down to the developer, brand, location and respective target markets.

In summary, our view is that the buyer market will need to accept this new pricing structure given it is unlikely that land values will fall substantially nor will building costs fall dramatically. In fact, Charter Keck Cramer’s view is that in Melbourne, the pre-COVID off the plan value rate of $10,000/sqm is now closer to $12,000/sqm, whilst the pre-COVID off the plan value rate of $12,000/sqm is now closer to $14,000/sqm. This requires a change in mindset that needs to be led by the development and financer industry after which the buyer market is anticipated to follow.

Set out below are some key factors for the industry to critically assess with respect to their projects and the apartment market more broadly.

Interest Rates & Consumer Sentiment

Interest rates have increased by 400 basis points since April 2022. This has diminished purchaser capacity by over -40%. Furthermore, consumer sentiment, as measured by the Westpac Melbourne Institute of Consumer Sentiment Index, remains in deeply pessimistic territory.

On the face of it, this appears to be a major risk for the apartment sector. It is also certainly one of the explanations for slow pre-sales rates in many projects. However, Charter Keck Cramer suggests that both of these factors stand to open up a very large (but slightly different) buyer and renter pool over the next 12+ months. The BTS apartment developers that understand and respond to these respective target markets stand to benefit.

When rates were at 0.1%, all potential buyers had much higher purchasing capacities. A segment of this cohort had the capacity to purchase a detached house or a townhouse whilst another segment that had the capacity to purchase an apartment. With rapid rate rises, there is anticipated to be a “shuffle” downwards (trade-off) where many buyers are forced to trade into medium and higher density dwellings as dictated by their revised finances.

For those that do not wish to buy, or now cannot afford to buy, will still need a place to live. This in itself provides renter demand which will be attractive to BTS apartment investors (as well as Build to Rent operators). Finally, with rapidly rising rents, it is also anticipated that some renters may make a financial decision to purchase and pay off a mortgage given that rental repayments may be similar to mortgage repayments in some markets and across various product types. It is anticipated that almost all of these potential buyers will seek the most affordable product type which will be BTS apartments.

This is the first key factor suggesting that BTS apartment pricing will need to adjust upwards and will be supported by the buyer market.

Gap Between Houses and Units

A metric that has historically been used to analyse the apartment market is the house to unit price ratio (or house to unit price “gap”). This is broadly based on the “house price hierarchy” which suggests that Australian buyers typically aspire to reside in a detached house in the location of their choice, but often trade-off dwelling type for location and purchase into medium or higher density dwellings in the location of their choice.

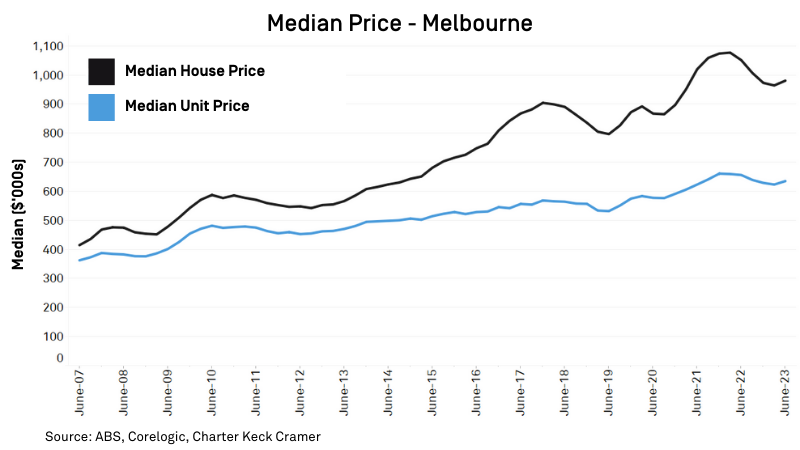

The long-term (10 year) gap between house and units in Melbourne has been 47%. The current short-term (2 year) gap is currently 60%. This is a function of the significant market distortions caused as a result of COVID where detached house prices increased by +24% over 2020-2022.

Charter Keck Cramer however cautions that this analysis, whilst helpful, must be fully understood to be meaningful. The “unit” dataset of most data providers comprises townhouses, terrace houses, villa units as well as flats and apartments and is not a true reflection of the prices of new contemporary apartments. Given that historically more medium density dwellings such as villa units, townhouses and terraces were delivered across Melbourne (at higher price points compared to contemporary new apartments) the gap was much closer a decade ago when compared to more recent times where greater numbers of contemporary apartments (at lower prices) have been delivered which has subsequently widened the gap.

That being said, the gap between houses and units is extremely large at present and in many respects the market is out of long-term equilibrium. Whilst house prices have fallen -9% since March 2022 house prices are still +15% higher than pre-COVID and are not anticipated to fall much further (in fact they may well continue to increase). Given the rapid rate rises, buyer demand will continue to be driven into more affordable dwelling types and BTS apartments stand to be the primary beneficiary of this dynamic.

This is the second key factor suggesting that apartment pricing will need to adjust upwards and will be supported by the buyer market.

Construction Costs & Land Prices

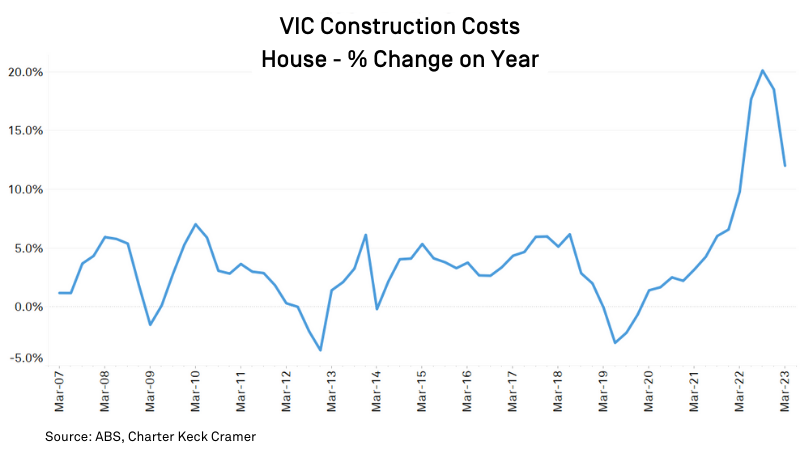

The industry is aware of the substantial increase in construction costs over 2020-2023. These costs have increased by the largest amount since the GFC or the introduction of the GST in 2000 respectively.Whilst it is positive to see that costs are slowing, Charter Keck Cramer’s discussions with many builders in the industry suggests it is unlikely that they will in fact decrease (or revert to pre-COVID levels). Furthermore, there is going to continue to be substantial competition and demand for labour given the city-shaping infrastructure projects being completed across Melbourne over the next few years. This stands to keep construction costs elevated in the short, medium and longer term.

Finally, in discussions with our Valuer colleagues, Charter Keck Cramer’s view is that land prices are unlikely to fall substantially (if at all) given the extremely restrictive planning system across Melbourne. In fact, our investigations with many sales agents suggest that well located quality sites are highly sought after and are increasing in value given many developers are aware of the substantial supply / demand mismatch occurring across Melbourne.

This is the third key factor suggesting that apartment pricing will need to adjust upwards and will be supported by the buyer market.

Supply of Apartments

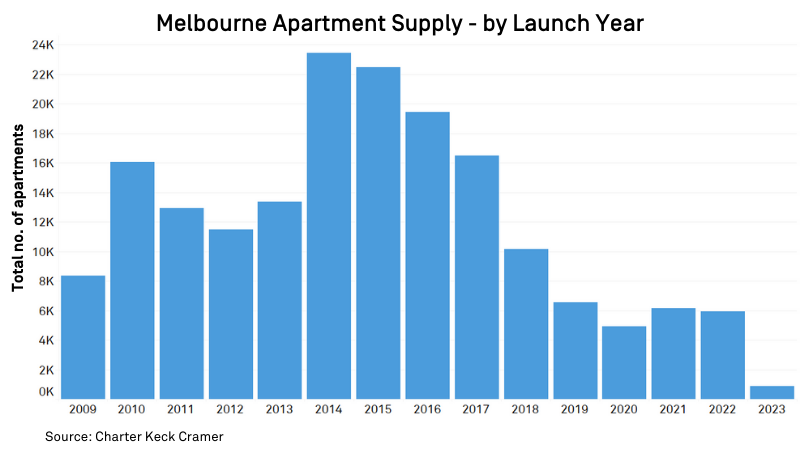

Charter Keck Cramer is in the process of preparing the State of the Apartment Market report for H1-2023. This report will be based on our National Apartment Database as at Q2-2023. The chart below shows the annual launches (For Sale) of BTS apartments across Melbourne over 2009 to 2023 (as at Q1-2023).

The key finding is that supply remains at incredibly low levels. When this is read in light of population growth being at decade highs, it is no surprise that vacancy rates are incredibly low and rents are rising so quickly. It is also an explanation for why Charter Keck Cramer feels that there will be a floor under price falls (if any) of established apartments, and also a fourth reason why we believe new apartment pricing will need to adjust upwards and will be supported by the buyer market.

2023 Apartment Value Rates

We remind the industry that quite simply, people need a place to live. Given the shortage of supply and substantial demand for housing there is going to continue to be a large mismatch between supply and demand for housing across Melbourne over the next 2-4 years (at a minimum).

Charter Keck Cramer has collaborated with our Valuer colleagues and sampled several BTS apartment projects of varying scale across 10 suburbs in Melbourne that have been launched for sale to market in H1-2023. We have endeavoured to compare BTS apartment projects of similar scale in the same suburbs (or buildings across various stages in the same project) to understand the relative change in off the plan value rates in projects as at 2018 and 2019 (pre-COVID) compared to 2023.

For the purposes of this exercise, the 2 Bedroom / 2 Bath product was used as it was the most popular product in the projects and allowed the most meaningful comparison to be made given there is little stock on the market at present. Whilst we are unable to publish the suburbs these projects are located in (as the industry would identify the projects and we need to maintain privacy) it is important to note that off the plan value rates have increased by +15% to +25% in several of these projects (in apartments of the same size).

At present, it is apparent to Charter Keck Cramer that the ability to increase off the plan value rates (and by how much) comes down to the developer, brand, location and target market. Some projects have increased value rates by only +2% to +5% whilst others have increased them by amounts greater than +25%.

To conclude, Charter Keck Cramer’s view is that in Melbourne, the pre-COVID off the plan value rate of $10,000/sqm is now closer to $12,000/sqm whilst the pre-COVID off the plan value rate of $12,000/sqm is now closer to $14,000/sqm. This requires a change in mindset that needs to be led by the development and financer industry after which it is anticipated that the buyer market will follow given they have limited other alternatives in the current market.

The Outlook

Charter Keck Cramer has spoken about the structural changes in living preferences that are occurring across Melbourne. These structural changes include the take up of apartment living, and also renting and renting for longer. It is Charter Keck Cramer’s view that the flow on effect of the pandemic described above has meant that the maturity of the BTS apartment market in Melbourne is in the process of being pulled forward (or “jumping”) by a property market cycle (i.e. 7-10 years). This will continue to play out over the next 12 months.

Part of this pull forward in market maturity (evolution) will be that larger numbers of occupiers embrace living in apartments as well as the buyer market accepting higher prices for BTS apartments as this product type continues to become more mainstream. The other critical part of this expedited apartment market maturity however is that developers will need to respond by delivering owner-occupier quality apartments. Some examples of these features include apartments with extra storage, lots of communal amenity, larger living areas, larger functional balconies and more 3 Bedroom apartments.

Charter Keck Cramer also believes that the RBA is close to the top of the rate tightening cycle. When rates stabilise, it is anticipated that market demand will start to be expressed and sales rates will accelerate. When rates start to be cut, there is anticipated to be an extremely elastic response across the entire housing market with the BTS apartment market well poised to be a primary beneficiary for many of the reasons highlighted above.

The industry is encouraged to continue to endure in these incredibly difficult times as the BTS apartment market will continue to improve. There are opportunities for those developers that are able to proceed with construction as the buyer market is seeking certainty with respect to both costs and timing, and these developers will be delivering completed stock into a severely undersupplied BTS apartment market over the next 2 years.

Final Thoughts

The Charter Keck Cramer Research team have received positive feedback from the industry in response to our insights. We welcome the discussion and wish to play a role in ensuring accurate, factual and balanced information is provided into the public domain.

We encourage the industry to contact us to share your insights and information so that we can get through this very difficult period for the Melbourne BTS apartment market together.