As featured in Australian Financial Review

12 June 2025

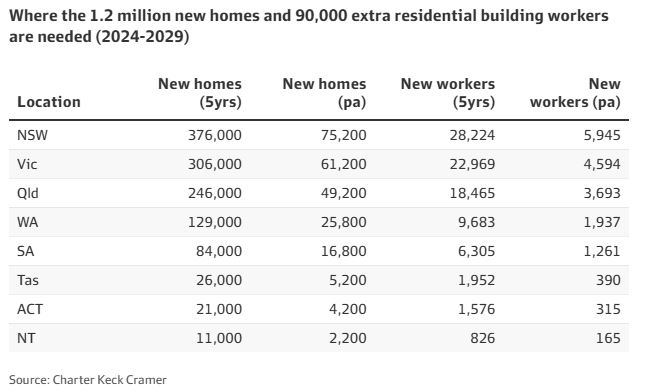

Queensland needs almost 18,500 extra building industry workers to meet its share of the country’s 1.2-million new-home target and is most at risk of falling short of that goal because the impending Olympic infrastructure surge will suck up labour and materials, Charter Keck Cramer says.

The northern state, with an estimated 246,000-home share of the five-year national housing accord target, accounts for almost one-fifth of the 90,000 extra home building workers needed nationally, but will struggle to secure the people it needs, especially from 2028, the consultancy said.

Queensland, with a population that grew by a net 111,900 people – or 2 per cent – over the year to September, is the policy crucible for a country trying to balance both the housing needs of a growing population and a surge in infrastructure investment, the latter of which will be supercharged by the Brisbane 2032 Summer Olympics.

The most intense period of Olympics-related demand will start in 2028, a year before the official mid-2029 end of the five-year national housing accord, placing extra pressure on an already-stretched building sector.

“The great risk lies in Queensland,” Charter Keck Cramer national executive director Richard Temlett told The Australian Financial Review.

“From 2028 to 2032 there’s going to be an even worse shortage of workers. The housing accord doesn’t finish and we’re into a period of extremely strong demand for infrastructure.”

Even with lower borrowing costs boosting demand and stable costs making development more predictable, the country was on track to fall 262,000 homes short of the five-year target, the federal Labor government’s own advisory body said last month.

"We need to have timing of delivery that reflects the property market cycle. The government didn’t get that quite right."

- Charter Keck Cramer director Richard Temlett

Queensland is already struggling to provide new housing. Official figures for the year to December show 10,531 completions of attached homes – apartments, townhouses and semidetached dwellings – less than half of the 22,634 completions chalked up in 2017, during the height of the last development boom in Queensland.

“We are substantially behind in meeting the targets for low, medium and high-density housing targets – but most particularly for high-density housing because we are competing for the same labour and resources as the state government is securing for its major projects,” said Brook Monahan, managing director of Mosaic Property Group, a Brisbane developer-builder.

“This situation reaches a critical pinch point between 2028 and 2032 as the Olympics program reaches the height of its rollout.”

The strength of demand poses risks for other states such as Victoria – where almost 23,000 more workers are also needed to deliver a 306,000-home target – which may have their workforce poached to go north, Temlett said.

But the lack of capacity to deliver 1.2 million new homes and bring Australia’s chronically undersupplied housing market back into balance was affecting every state and territory, he said.

NSW needs over 28,000 more workers and WA nearly 9700, he said.

Even so, rather than ditch the aspiration for so much new housing, the targeted time frame – hit badly by the COVID-19 pandemic and subsequent soaring building costs – should be extended, Temlett said.

“We need to have timing of delivery that reflects the property market cycle,” he said. “The government didn’t get that quite right. “To do it over 7-10 years, from 2032-2035 … would have a hugely positive impact on Australia.”

A government spokesperson declined to comment on changing the timeframe.

“The Albanese Government is committed to meeting Australia’s national priorities, including in housing construction,” they said.

“We are building a migration system that delivers the skills we need, in lock step with domestic training, including in construction. We’ve prioritised construction skills within the temporary and permanent visa systems.”

Meanwhile, the Queensland industry is trying to reduce the risks it faces.

In Gold Coast’s Mermaid Beach, developer-builder Aniko Group has brought forward construction of a $2.5 billion, four-tower residential project of almost 1000 units to build the 240-unit tower 1 and 140-unit tower 2 concurrently, to avoid an impending crunch on labour and material.

“We were only ever going to build stage 1 and stage 2 in line, one after the other,” Aniko managing director George Mastrocostas told the Financial Review. “We’ve fast-tracked it to be able to build both stages concurrently.”

Risks for commercial builders and developers were increasing, Mastrocostas said.

“If you have a project of significant size you’re looking to begin in the next five years, the sooner you can get it out of the ground the better,” he said. “It will only get more difficult to get trades.”