21 June 2023

This insight examines Millennials and the demands created by this market segment as they transition into the next stages of their lives.

As the housing markets across the capital cities of Australia continue to evolve and mature, it is important to understand that the types and locations of dwellings that have been built in the past are not necessarily the same as the types and locations of dwellings that need to be built into the future.

This is the second in a series of insights where Charter Keck Cramer will explore the demand being created for various types of dwellings, and in various locations, across the capital cities of Australia.

Who are Millennials?

Millennials were born between 1981-1996. Many have in fact been born to the Baby Boomers and many that were born in Australia have grown up in detached houses owned by their parents in what have historically been the inner, middle and outer rings of the various capital cities. Over the last few decades, the capital cities have expanded their respective urban footprints to accommodate the rapidly growing population(s) and these areas now, for the most part, form the “Middle” Rings* of the capital cities in Australia.

Millennials, like every generation, are very different to their Baby Boomer parents. Many are getting married and having children later in life, are travelling earlier in life, are changing their careers more often and staying in their current jobs for shorter periods of time when compared to their parents. Most relevantly, Millennials also have different dwelling preferences (many forced whilst some preferred) and this will drive the demand for different types of dwellings across the capital cities over the next decade and more.

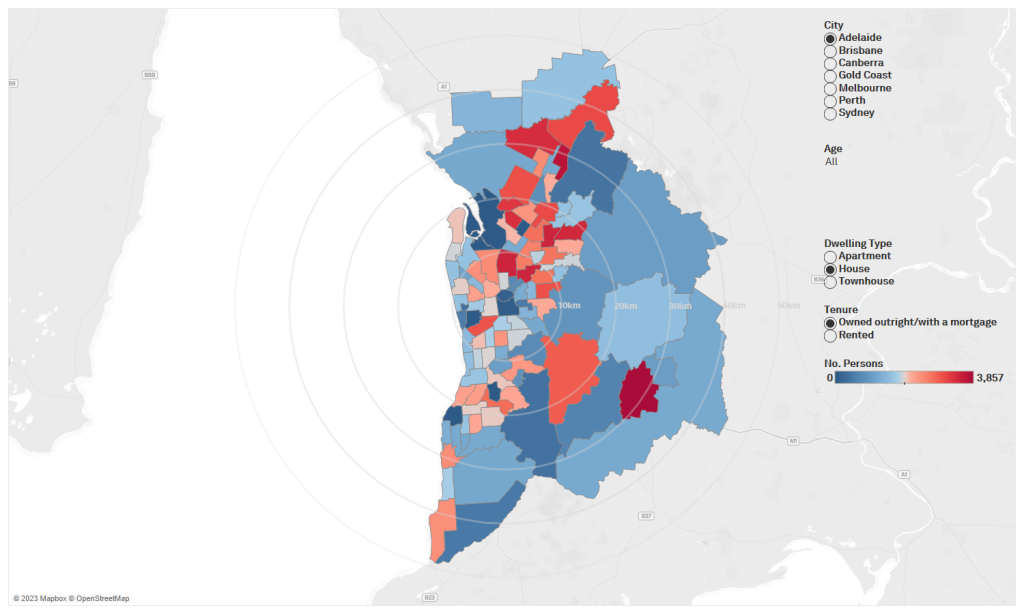

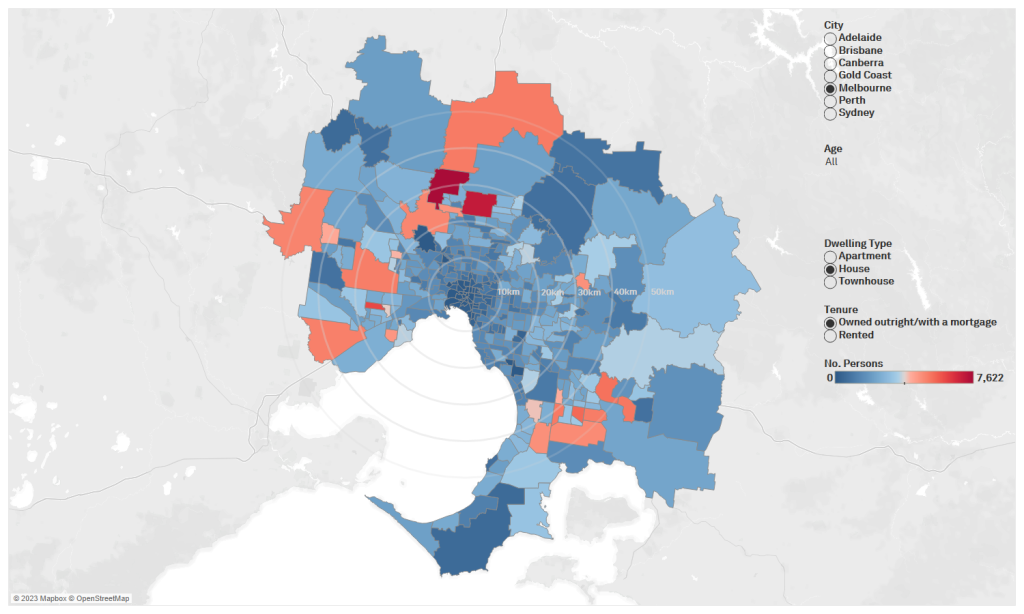

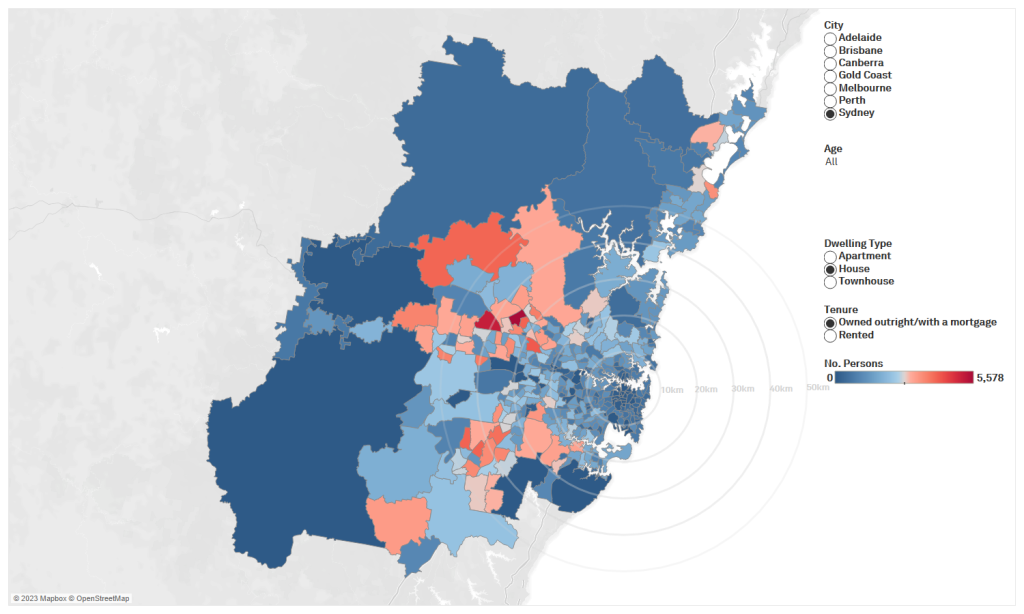

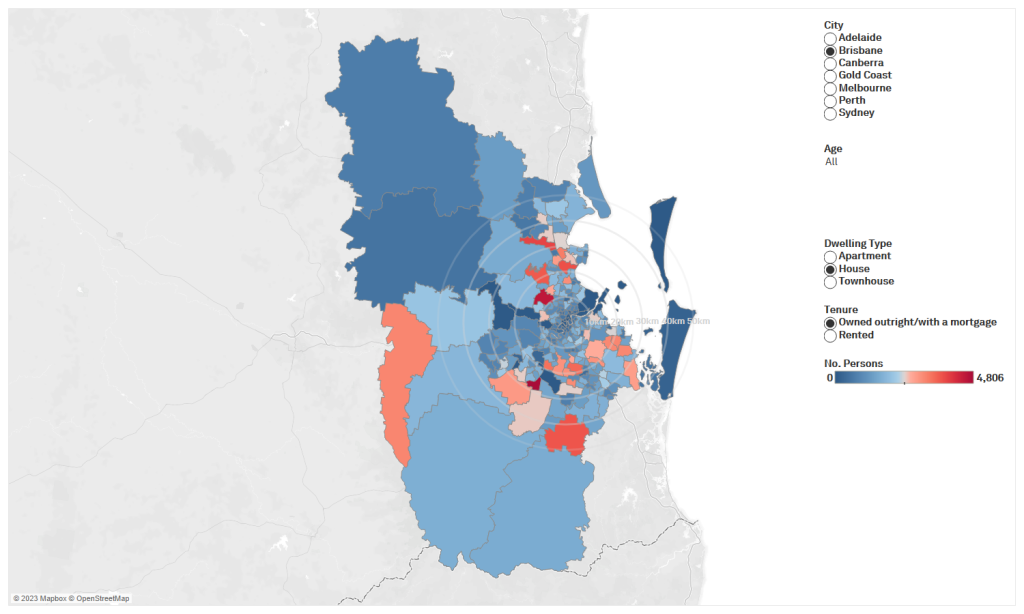

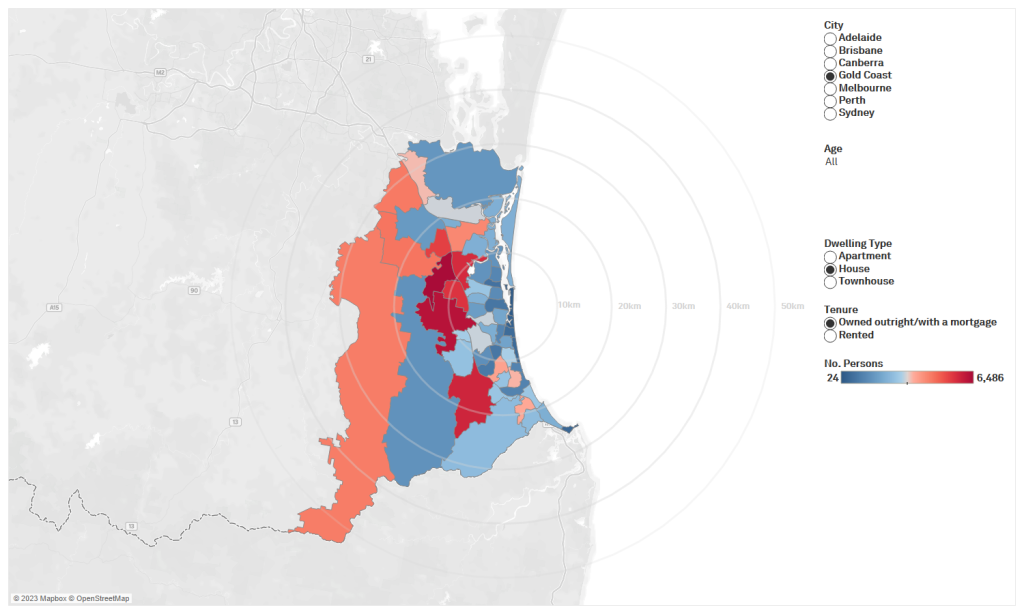

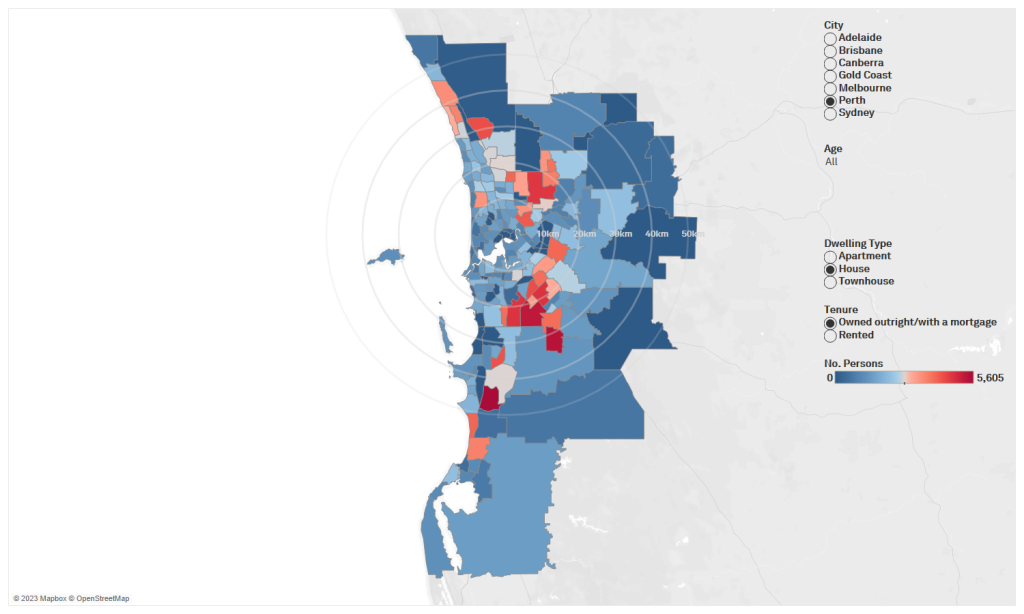

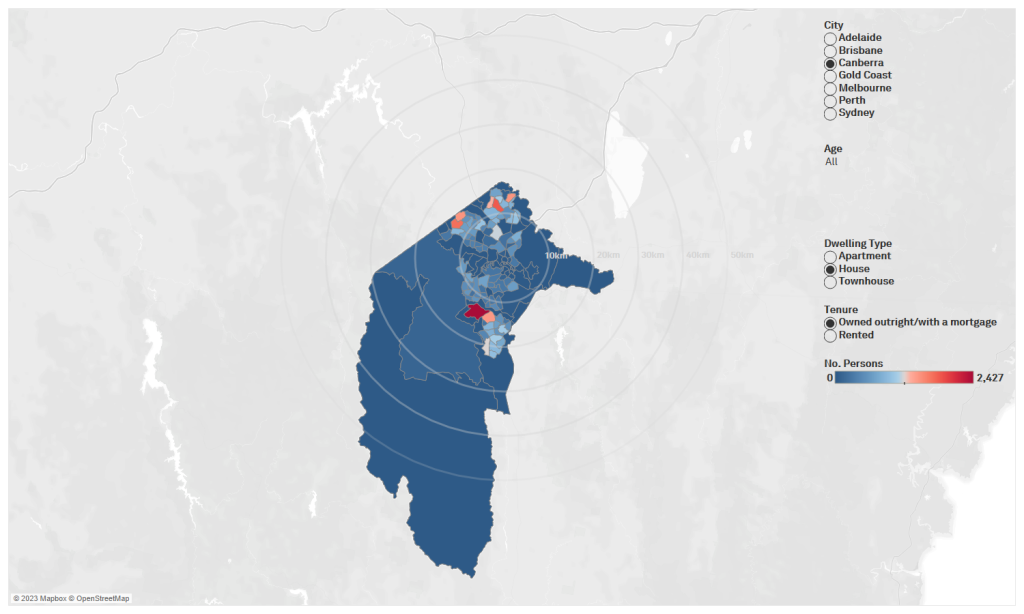

The maps in this insight show the types of dwellings (houses, townhouses and apartments) as well as the various tenures (own with / without a mortgage or rent) that have been occupied by Millennials that have moved out of the family home.**

It is evident that as Millennials have moved out of the family home, they have had to make a choice (trade-off) between the location in which they will live, the prices / rents they will pay as well as the type of dwelling in which they will live. This is most pronounced in the East Coast cities of Sydney, Melbourne and Brisbane which have some of the highest house prices across the country.

Charter Keck Cramer notes that many Millennials have over the last decade been price and product “takers” given they have not (yet) reached peak earning capacity in their careers. Due to this, many Millennials have been displaced from the Middle Rings of the capital cities because there is an absence of suitable housing choice at price points and weekly rents that meets their financial and lifestyle needs.

This is a direct result of the Middle Rings having some of the most restrictive planning schemes (which prevent increased density of development) and consequently some of the highest house prices in each respective capital city.

The maps start to illustrate the following:

Houses – The Great Australian Dream is still alive and Millennials that have chased it (in the absence of assistance from their parents / and or having the highest paying jobs) have had to leave the Inner and Middle Rings and move to greenfield markets (typically in the Outer Rings) to purchase their detached home.

Medium and higher density dwellings – Many Millennials have traded-off dwelling type for location and occupied medium density dwellings (such as villa units, townhouses or terrace houses) or higher density dwellings (apartments or flats) in the locations that they have been delivered. A key point to observe is that majority of medium and high-density dwellings have been supplied in certain locations across the various capital cities and this is where Millennials currently reside in largest numbers. Importantly though, there are pockets in the Inner and Middle Rings that have delivered these forms of dwellings, and this has allowed Millennials to live in these locations.

It is essential to note that the most recent 2021 ABS statistics show that a large percentage of Millennials that have moved out of the family home rent the dwelling in which they are living (53% in Sydney, 44% in Melbourne, 47% in Brisbane). The statistics further show that over the last 15 years (2006-2021) a much larger percentage are also now living in high rise apartments with 4+ levels (27% up from 12% in Sydney, 12% up from 3% in Melbourne, 9% up from 2% in Brisbane).

For many Millennials, renting as well as living in either a townhouse or an apartment is a forced choice as they have simply been priced out of the housing markets across many of the capital cities (particularly Sydney and Melbourne). There are however a portion of the Millennial population that do not wish to have a 30-year mortgage and are prepared to put their money into the share market and remain more transient. There is also a segment that are prepared to reside in apartments or townhouses longer term, particularly if they are well built and close to their sources of employment and amenity. Finally, a large segment of Millennials are in fact from overseas and have brought with them their living preferences, which depending on their ethnicity, is already for higher or medium density living.

The next 10+ years

It is important for Government, as well as the development industry to appreciate that as at the 2021 Census, Millennials represented the same proportion of the population as Baby Boomers (both at 21.5% of the Australian population). This is the first time this has occurred in Australia and presents a large demographic and structural shift in the population which will flow into the housing market.

Over the next decade Millennials will begin to outnumber Baby Boomers and will start to move into peak earning capacity as well as continue to have children. This change in financial circumstance and lifestyle will continue to drive demand for dwellings in the Middle Rings close to some of the best schools, hospitals and amenity. This is at the same time as their Baby Boomer parents will need to make a financial and lifestyle decision about their own housing requirements.

As it stands, many Baby Boomers don’t have suitable dwellings to move into and will remain locked in the Middle Rings in their detached houses whilst Millennials also don’t have suitable dwellings to move into and will remain locked out of the Middle Rings. Worse still is that many Baby Boomers will be forced to live far away from their children and grandchildren which is an unacceptable (but avoidable) outcome.

It is important for an honest conversation to be had about density. It is essential to get diverse types of dwellings at greater densities into these markets to allow all age groups and household types to age through a suburb. Diverse types of dwellings, which accommodate diverse age groups of people through the different stages of their lives, provides a housing market with balance. This will have a positive impact on the liveability, affordability and overall attractiveness of these housing markets.

The maps show some of the opportunities which have already started to be expressed when there is an alignment between facilitative planning policy, infrastructure development and market demand, summarised below:

Build to Rent (BTR) apartments – Given affordability issues in Sydney, Melbourne and Brisbane, BTR has a significant role to play to house a large segment of the population. As many Millennials both rent and also already reside in higher density dwellings, they will be the first adopters of BTR (vertical and horizontal) and their living preferences will drive demand for this product. In due course, it is anticipated that different ‘tiers’ of BTR will be introduced as the market de-risks and it is anticipated that more affordable BTR will be delivered (much like has occurred in both the USA and the UK) across the capital cities. Charter Keck Cramer’s research to date also indicates that some of the largest opportunities for BTR exist in the Middle Rings of several of the capital cities.

Build to Sell (BTS) owner-occupier apartments – Given affordability issues in Sydney, Melbourne and Brisbane and the difficulty in saving a deposit for a detached house, apartments are a good starting point for many Millennials to get onto the housing ladder. They also offer the most affordable weekly rents which can start to address some of the issues with housing affordability given they are typically delivered into the lower to median price and rent quartiles of a housing sub-market.

Townhouses and terrace houses – This product type will allow many Millennial families to enter into the Middle Rings of the capital cities and be close to schools, infrastructure and amenity. They are also an excellent compromise and a stepped change response to density given they are typically delivered over 2 or 3 levels.

Detached houses – The great Australian Dream is still alive to many Millennials. The greenfield markets must still play an important role across all the capital cities to cater to those buyers who aspire to live in this form of housing.

Government

All sides of politics, and all levels of Government, are encouraged to start making decisions with both Millennials and Baby Boomers in mind. This requires a change of mindset and understanding of both the competing and complimentary needs of Millennials and Baby Boomers respectively.

Quite simply, Government need to start to facilitate the supply of additional and diverse dwellings to open up many locations across the capital cities. Government is encouraged to take a proactive, brave and longer-term approach to address this issue. Changes to planning schemes which allow greater certainty and speed to market and greater forms of housing density (i.e. townhouses, terrace houses, BTS apartments and BTR apartments) are essential. Changes to various taxes and charges (such as the removal of stamp duty / land transfer duty which is an incredibly inefficient tax) are also necessary to facilitate the cost-effective transition of Millennials (and Baby Boomers) into different types of dwellings.

Government must also realise that decisions made today will impact the housing markets of tomorrow. Having studied several housing sub-markets, Charter Keck Cramer observes that decisions relating to planning and planning schemes in fact take one or more housing market cycles (7-10 years) to flow through at scale, whereas changes relating to tax settings that facilitate the production of new dwelling take anywhere from 2-4 years to flow through at scale.

Opportunities for Developers and Financiers

Many of the capital cities are currently experiencing their strongest levels of population growth on record (through overseas migration). These residents need a place to live and substantial opportunities are in locations such as the Middle Rings where land values are high enough, and land parcels large enough, to support feasible development of various forms of housing at scale.

The development and finance industries are also encouraged to continue to seek out innovative housing solutions and finance models that meet the demands and respond to the lifestyle and financial needs of the Millennial segment of the market.

*Middle Rings for each capital city are defined broadly, from the GPO’s, as follows: Sydney (10-30km), Melbourne (10-20km), Brisbane (2-10km), Perth (2-10km), Adelaide (2-5km) and Canberra (2-5km).

**The maps show the count of persons (rather than households). Houses = detached houses, Townhouses = villa units, townhouses and terrace houses and Apartments = flats and apartments.

CLICK HERE for an interactive view of each Australian capital city.

Melbourne

Sydney

Brisbane

Gold Coast

Perth

Canberra

Adelaide