As featured in BTR News Australia

18 September 2025

Melbourne's Build to Rent sector is the most mature of all Australian capital cities, benefitting from strong levels of demand, according to Charter Keck Cramer.

Property consultancy Charter Keck Cramer has released its State of the Market H1 2025 report, highlighting that FY 2025 was another difficult year for the Melbourne Build to Rent and Build to Sell apartment markets.

Charter Keck Cramer’s views are that 2024 was the ‘cyclical trough’. The firm’s research with stakeholders suggests that various key metrics in the state are already starting to shift which will present significant opportunities over the next few years.

Developers are finding obtaining both planning permission, alongside finance, the easiest it has been in the last five years and builders and sub-contractors are also quoting competitively for new work and completing projects ahead of schedule.

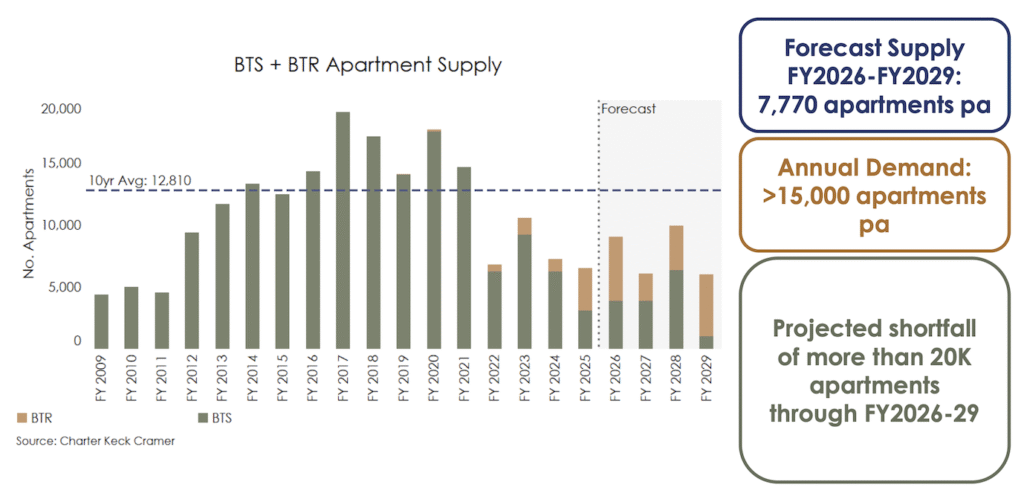

Overall apartment supply has improved compared to 12 months ago, although is it significantly below the levels required to meet the relevant housing targets. Alarmingly, Build to Sell supply of 3,070 apartments is the lowest amount recorded and underscores just how hard Build to Sell market conditions are in Melbourne at present due to revenue inelasticity.

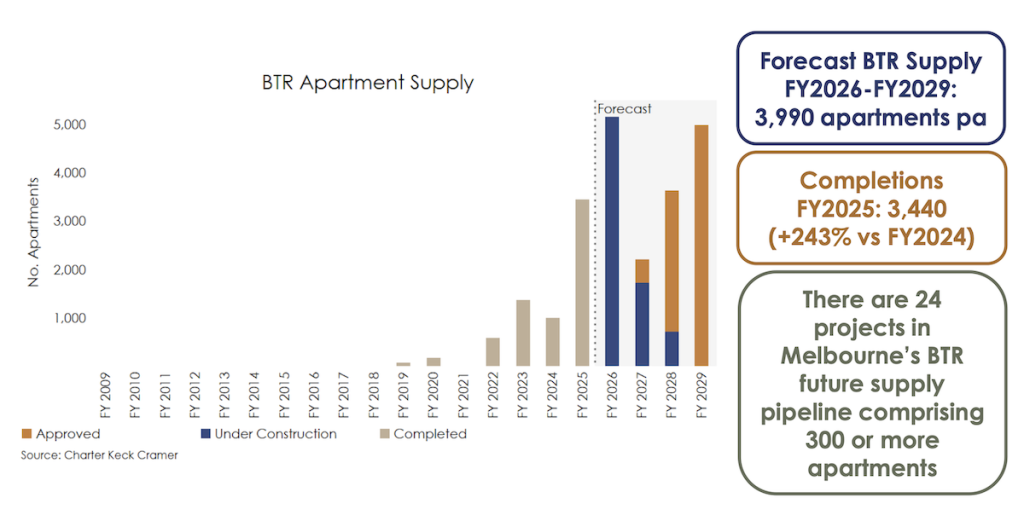

Build to Rent supply has done a lot of the heavy lifting with 3,440 apartments (53% of the total supply for FY 2025) being delivered, which highlights the key role the sector continues to play, according to Charter Keck Cramer. Demand remains extremely strong and continues to be driven by net overseas migration.

Charter Keck Cramer is also observing that residents are returning from interstate given the more affordable price points and rents in Melbourne. This, combined with rate cuts and investor interest from interstate and overseas, is likely to assist with allowing the established housing market to re-rate upwards which will in turn unlock the new housing and apartment market.

The firm’s investigations show that 2025 new apartment Build to Sell price points and value rates are being achieved however these sales are very slow and the product is much larger than the typical investor-grade product of ten years ago.

The product offering is also very different to meet a more discerning owner-occupier market. Charter Keck Cramer’s research has however highlighted that there is a major pricing delta in new Off the Plan projects between blended project rates, what has been sold and what is currently unsold in many projects.

Build to Rent operators report that projects are leasing up quickly and weekly rents are being achieved. Rental renewals and growth is also meeting the project underwrite across most dwelling typologies and returns are likely to improve with rate reductions.

There has been a noticeable increase in activity in the debt space by the Big Four banks although equity capital remains difficult to raise unless projects are packaged with a DA and builder ready to proceed.

Major infrastructure projects such as the Melbourne Metro Rail are having a positive impact on the outlook for apartment development in Melbourne. St Kilda Road has been a major centre for activity with various developers positioning their projects for the catalytic effects the Melbourne Metro Rail project will have on this sub-market.

Charter Keck Cramer observes that Melbournians are ‘extremely negative’ about Melbourne however interstate investors and also overseas investors hold different views and can see the significant value in this city at present.

The firm anticipates a tipping point is coming where the onerous taxes and charges imposed on Melbourne property will be outweighed by the attractive price point and strong weekly rent (and yields) that could be achieved by new product in Melbourne by investors. This will start to manifest as rates continue to fall and the delta between Sydney and Brisbane pricing compared to Melbourne pricing becomes even more pronounced.

A significant volume of Build to Rent apartments are projected to be delivered in Melbourne over the next four years. However, raising equity capital will continue to be challenging for projects carrying planning or builder uncertainty.

To accommodate the city’s growing population, Charter Keck Cramer conservatively estimates that there is underlying annual demand in Melbourne for at least 15 thousand additional apartments per annum for Build to Rent and Build to Sell combined.

Apartment demand will continue to outweigh supply over the coming years. This imbalance, combined with further interest rate cuts and improving sentiment, is expected to generate positive price growth in Melbourne’s apartment market.

Charter Keck Cramer’s view is that Melbourne is undervalued and holds the greatest upside of all the cities around Australia. The city has since August 2025 already started to re-rate from a pricing perspective, and how quickly this re-rating continues comes down the RBA, APRA and the State Government making the correct policy decisions which acknowledge the challenges of the current economic and property market cycle.