Introduction

The Sydney CBD office sector continues to suffer the effects of weakened office occupancy conditions coupled with supply lag from the previous cycle. It is yet to be seen how effective recent NSW Government mandates for their employees to return to the office will be and progress in reducing vacancy may be stifled by large tenants reducing their CBD footprint. As a result, tenant incentives remain significantly elevated albeit face rents are relatively stable.

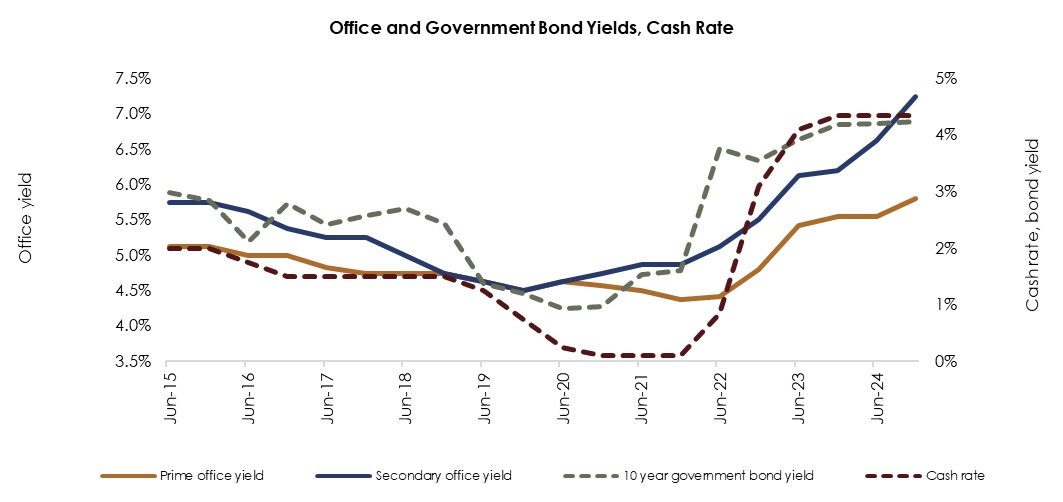

Sales volumes in Sydney CBD have slumped in recent times as the market contends with weakened tenant demand and occupancy rates impacting cashflow. Compounding this, an elevated interest rate environment has led to an increased cost of debt and yield softening. The combined effect of these has negatively impacted commercial loan serviceability and is stifling deal flow. Charter Keck Cramer is of the opinion that the gap between vendors and purchasers is narrowing and that the market is likely to see increased transaction volumes through the second half of 2024 and 2025 as it recalibrates.

Charter Keck Cramer is tracking the bifurcation of prime (Premium and A-Grade) and secondary (B-Grade and below) yields during this cycle and are of the opinion that this has, to some degree, been masked to mid-2024 by the lack of secondary investment grade transactions. It is likely that secondary yields have softened significantly more than prime yields and the extent of this softening will become apparent as transaction volumes increase.

The Sydney CBD is undergoing extensive re-shaping with the recent delivery of the new Metro Line connecting Martin Place and Barangaroo to North Sydney. Additionally, the 2032 forecasted completion date of the Metro West line will further improve CBD connectivity with trains running from Hunter Street through the inner western suburbs to Westmead and Parramatta. The completion of early stages of the Metro will substantially improve connectivity to Sydney CBD from Northern and Northwestern suburbs which may have a positive effect on office occupancy rates and the CBD landscape as construction projects come to an end.

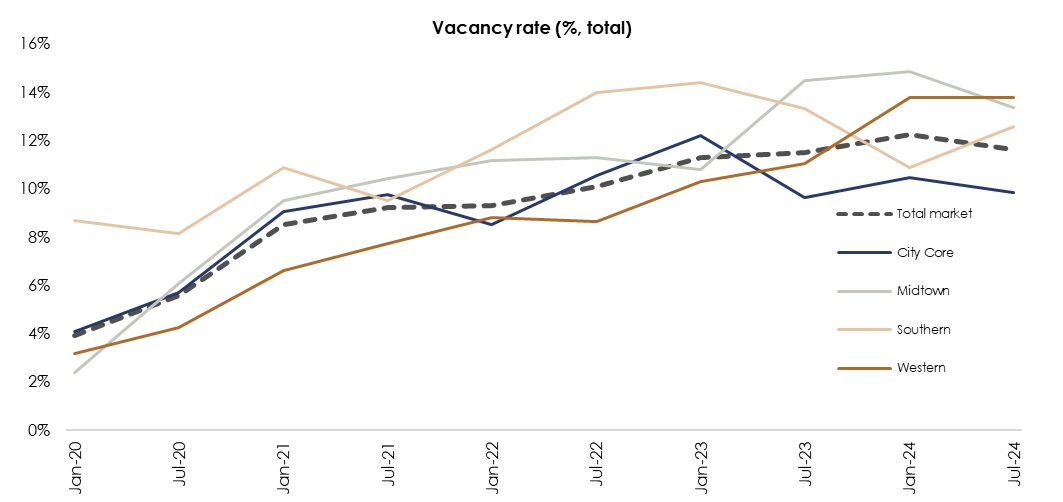

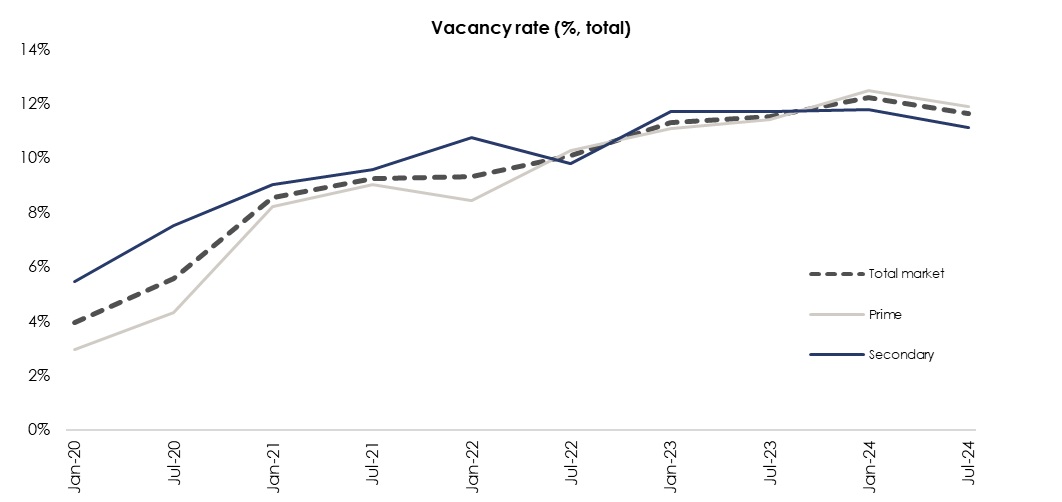

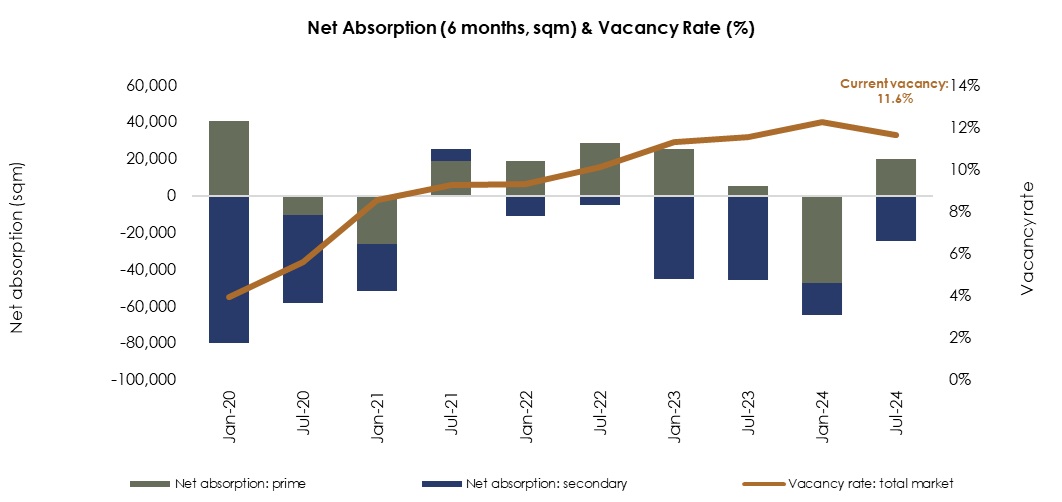

Vacancy & Net Absorption

- Total vacancy has decreased from 12.2% in Jan 2024 to 11.6% in July 2024.

- Negative net absorption of -64,600 sq.m. across the past 6 months was primarily driven by large occupiers such as Westpac, CBA and AMP reducing their footprint.

- The 25 largest occupiers reducing their footprint has resulted in 43% of vacancy increases since Q1 2020.

- Subleasing offering from Salesforce (7,700 sq.m. at 180 George St) and AMP (3,600 sq.m. at 33 Alfred St) has resulted in the subleasing vacancy figure remaining above 1%.

- The Prime Grade Core Market continues to outperform the rest of the market with 9.8% vacancy when compared to the Western Corridor and Midtown precincts with vacancy hovering around 13.5% proving that tenant focus is primarily on high quality, centrally located office assets.

Source: Property Council of Australia Office Market Report

Source: Property Council of Australia Office Market Report

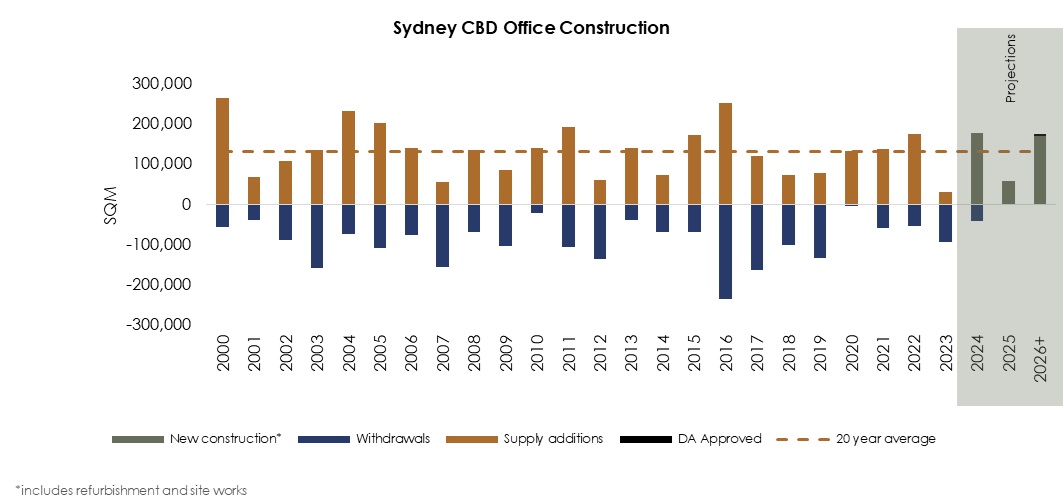

Recent Additions

The August 2024 delivery of the Martin Place Metro North and South Towers (1 Elizabeth St and 39 Martin Place) have resulted in the addition of 62,000 sq.m. and 30,000 sq.m. respectively. However, these recent completions are not reflected in the PCA data due to the project delivery being after the July 2024 PCA data release.

Supply Withdrawals, Pipeline & Net Absorption

Recent Supply Withdrawals:

- Reserve Bank Building – major refurbishment, 25,156 sq.m.

- 11 Barrack Street – major refurbishment, 1,700 sq.m.

- 133 Liverpool Street – demolition, 15,000 sq.m.

Charter Keck Cramer notes that the NSW Government and private landlords have been reviewing the potential conversion of low-grade vacant office buildings to residential apartments. At this stage such projects are unlikely to be feasible due to poor light penetration and prohibitive costs, among other factors.

Proposed Supply Pipeline:

- Parkline Place, 250 Pitt Street – 47,839 sq.m. across 35 floors (Investa, PC: 2024).

- Merchant House, 333 Kent Street – 14,170 sq.m. across 16 floors (Addenbrooke, PC: 2024)

- DA Approval given for a 55-storey office tower on Hunter Street above the proposed Hunter Street Metro Station.

Notable building due post 2026+

- 55 Pitt Street (Mirvac, PC: 2026+)

- Tech Central Precinct (various, PC: 2026+)

- Chifley South (Charter Hall, PC: 2027+)

Source: Property Council of Australia Office Market Report

Source: Property Council of Australia Office Market Report

Yields

- Charter Keck Cramer is tracking Prime yields and expect that secondary yields will soften substantially more than prime yields as the market corrects for interest rate increases and cashflow impacts.

- The extent of yield softening has to some degree been masked to date due to low transactional volumes and a lack of pressure on commercial landlords to divest assets.

- There have been very few sales of investment grade assets since early 2022 and the commencement of the RBA’s interest rate softening. This has predominantly been due to a gap between vendors and purchaser pricing expectations. Charter Keck Cramer is of the opinion that this gap is narrowing, and we expect to see increased transactional volumes through the second half of 2024 and 2025.

Source: Property Council of Australia Office Market Report

Market Outlook

- The next set of PCA data scheduled for publication at the end of the year may show a small increase in vacancy due to the delivery of 187,000 sq.m. of prime office space. However, due to high pre-commitment levels of recently completed buildings and a slowdown in upcoming supply until 2026, we expect vacancy to quickly stabilise.

- The Government instruction for employees to return to the office and reduced commute times on the recently delivered Metro may result in an increase in the office occupancy rates.

- There remains a proportion of existing office space that is leased but unoccupied, particularly in lower A and secondary grade buildings leased to large corporate tenants. There has been a trend over recent times for these tenants to downsize at lease expiry. We consider this will continue for some time creating a lag effect for vacancy rates.

- Charter Keck Cramer expects that there will be increased sales activity throughout the remainder of 2024 and in 2025 as the gap between vendors and purchasers narrows and increased hold costs coupled with weakened cashflows forces some owners to recycle capital.

Charter Keck Cramer is tracking prime and secondary yields through this market correction and expects that secondary yields will soften further than prime, and that this will play out in the next round of transactions over the coming 6-12 months.

Get in touch with our experts!

Mark Willers - National Director | Valuations - Commercial

Brendon Woolley - Director | Research

Jim Paxinos - Associate Director | Valuations - Commercial

Samantha McGrail - Associate Director | Advisory

Oliver Daniel - Executive | Advisory

This Insight has been carefully prepared by Charter Keck Cramer. This Insight does not render financial or investment advice and neither Charter Keck Cramer nor any persons involved in its preparation accepts any form of liability for its contents. The information contained herein was compiled in October2024 and should not be relied upon to replace professional advice on specific matters. Charter Keck Cramer is not providing advice about the suitability of investment in any specific project or financial product and is not a holder of an Australian Financial Services Licence. This Insight is Copyright and cannot be reproduced without written permission of Charter Keck Cramer.

© 2024 Charter Keck Cramer