Demographic change and affordability constraints point to high demand for one-bedroom apartments in the coming years. Despite this, recent projects often demonstrate a reduced proportion of one-bedroom apartments relative to previous cycles. The following insight unpacks this idea and highlights the various opportunities that are arising for both BTS and BTR apartment developments across Melbourne.

There has been a wealth of discourse surrounding the negative impact of increased project costs upon the total supply of apartments across Melbourne. Less discussed is how this is shaping the unit mix of the apartment supply pipeline. Charter Keck Cramer has observed, and in certain cases advised for, a reduced proportion of one-bedroom accommodation within upcoming build-to-sell (BTS) apartment developments in Melbourne.

The central constraint is the price ceiling of the product and the associated inability to offset higher project costs (construction, consultancy, holding and financing). In short, prices of one-bedroom apartments cannot be increased to the same degree as other configurations due to the generally limited financial capacity of the purchaser and the ultimate rental value if intended for an investment.

Across Melbourne, value rates often need to reach upwards of $14K p.s.m. on a blended basis for apartment development to be viable under current market settings. For a 55 sq.m. one-bedroom apartment, this equates to a price point of more than $750K. While demand at this price point exists, the depth is shallow and will inevitably have a dampening effect on sales velocities (per month) and the overall blended rate (per square metre) for the project if more competitively priced. Consequently, many developers are opting to either decrease or omit the provision of one-bedroom configurations in the product mix.

At present, the gap between the price of off-the-plan one-bedroom product close to a project’s required blended rate versus established one-bedroom (and in some cases two-bedroom) units is too large to attract widespread purchaser demand. Until such a time that pricing in the established market increases, the feasible delivery of one-bedroom apartments at higher values will remain challenged for many BTS projects.

Steered by occupier demand, favourable planning controls and the capitalisation of strong transport, employment and education attributes, Melbourne LGA has historically been the most supportive market for new one-bedroom product, followed by Port Phillip. Whilst there were several emerging sub-markets prior to the onset of the pandemic, the subsequent market distortions have eroded the market depth at the new price points within many of these locations. To reinforce an earlier point, there are examples of established one-bedroom apartments transacting at beyond $750K (some even $1M+), however, this is being achieved in select locations with limited opportunities for replication.

Supply-side constraints aside, demand for one-bedroom accommodation will be robust and present opportunities for the development industry moving forward. Government projections indicate that lone person households will undergo significant growth over the next decade. This is a cohort that drives demand for one-bedroom apartments at a high rate within both the For Sale and For Rent markets.

More than 30% of lone person households occupy one-bedroom apartments across Melbourne. Assuming this propensity remains equal (which is conservative), this would equate to a need for an additional 30K one-bedroom apartments across metro Melbourne by 2031. By the same logic, couples will drive demand for an additional 20K one-bedroom apartments.

Moreover, affordability pressures are reinforcing the attractiveness of one-bedroom apartments for both renters and owner-occupier purchasers alike. Prices will inevitably increase as purchaser demand is funneled into established (incl residual) stock, in turn improving the viability of new stock.

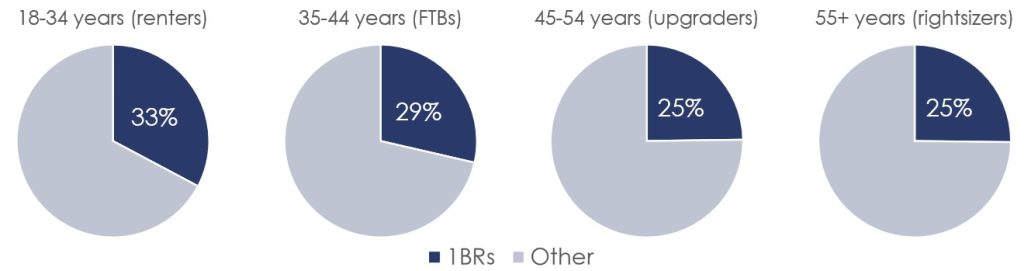

% apartment households occupying one-bedroom by age - Greater Melbourne

SOURCE: ABS2021, Charter Keck Cramer

Opportunities in the BTS market

While many recent BTS projects are targeting downsizer purchasers with premium quality two- and three-bedroom accommodation that carry lofty price tags and large NSAs, the appetite of this cohort for compact configurations cannot be ignored (refer chart above). For younger purchasers, one-bedroom apartments often represent an affordable housing option in a less affordable location. This allows them to transition from share houses or the family home and benefit from the security of home ownership while not sacrificing proximity to lifestyle and employment opportunities.

Many of these persons are finding themselves priced out of new projects, leading them to become increasingly active in the established market or choosing to remain on the sidelines, thus contributing to latent demand.

Charter Keck Cramer anticipates that Melbourne’s established unit market will continue to recalibrate upwards over the next 12 months. As the new vs established price gap closes, there is expected to be an elastic response in demand for off-the-plan one-bedroom apartments at higher price points. In the meantime, projects that are well positioned to deliver competitively priced and well-designed one-bedroom apartments are expected to be met with market acceptance from a variety of purchasers and face little competition from new supply. In some instances, this may require developers to push the prices of larger apartment configurations in order to support the blended value rate of the project.

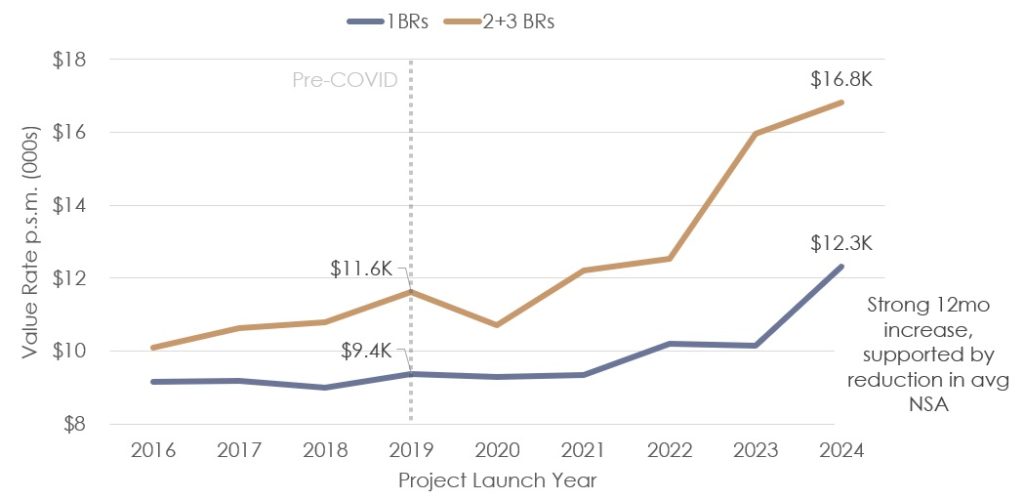

Escalation of Off-The-Plan Value Rates by Apartment Configuration - Metro Melbourne

SOURCE: Charter Keck Cramer. 2BRs = 2 bedrooms, 2 bathrooms

There is evidence of recent projects providing smaller one-bedroom apartments as a means of pushing value rates and keeping price points attractive. Such projects have recorded strong sales velocities for sub-$700K one-bedroom product. At the same time, Charter Keck Cramer has observed an appetite from purchasers for apartments comprising a multi-purpose room (MPR). This does not increase the NSA to the extent of a second bedroom but is proving to be valued by the market and helping to make higher price points more palatable. For developers aiming to raise the price ceiling, incorporating MPRs into one-bedroom product is a key consideration.

Opportunities in the BTR market

Given the supply-side constraints that exist in the BTS market, BTR developments have a unique opportunity to cater to this mismatch of supply and demand by providing high proportions of one-bedroom apartments.

These assets have the added benefit of creating wider market appeal for smaller configurations through their (typically) higher provision of amenity. For example, where owner-occupiers place a high value on a spare bedroom or study to enable them to work from home, many BTR projects offer co-working spaces to tenants which eliminates the need for auxiliary space.

Opportunities for Government

Delivering one-bedroom apartments is important to achieve various Federal, State and Local Government housing goals. This includes meeting overall dwelling targets (particularly within inner city locations) and providing a diversity of housing, as well as affordable and key worker housing.

To aid in the delivery of this product, government can consider a range of levers, including the following:

- Flexible planning policy to allow development to meet market demand. Government should avoid rigid planning policy that impedes supply meeting occupier demand. An example of this is within the Fisherman’s Bend precinct where the planning framework stipulates a minimum provision of 20-30% three bedroom dwellings within developments of more than 100 units. From a BTR perspective, this proportion is beyond what renters are demanding in the area. ABS 2021 data indicates that local renters are seeking three-bedroom accommodation at a far lower rate than their owner-occupier counterparts - a gap likely only widened by the rental premiums attracted by a BTR project. Secondly, a reduction in this provision would allow for BTR projects to partly offset the shortfall of one-bedroom accommodation currently being delivered in the BTS market.

- Reintroduce off-the-plan duty concessions and exemptions for investors and reduce foreign buyer levies. Property tax reform is an essential step to boost housing supply across Melbourne. There has been a marked decline in Melbourne’s apartment launches and subsequent completions since the abolition of investor stamp duty concessions and exemptions for off-the-plan properties (2017) and the increases to foreign investor surcharge (2016 & 2019). Recent rises in construction costs and interest rates have only compounded this slowdown. Despite political reservations about investors, it is crucial to acknowledge their role in supporting new housing supply for Victorians. This cohort will drive sales (and rental supply) of new one-bedroom apartments due to the attractive yields and price points.

Get in contact with our expert!

Ben Carter - Associate Director | Research