31 January 2023

The Built to Sell (BTS) apartment market is incredibly complex and often misunderstood. This frequently leads to risks failing to be identified and mitigated, as well as opportunities not being maximised.

The typical BTS apartment development process is that a developer purchases a site, obtains development approval for a project, launches the project to market, obtains sufficient presales to obtain construction funding and then builds out the project. This process can take anywhere from 2 to 4+ years depending on various factors such as the size of the project, point in the market cycle, relevant sub-market, and more recently the availability of materials and construction cost increases.

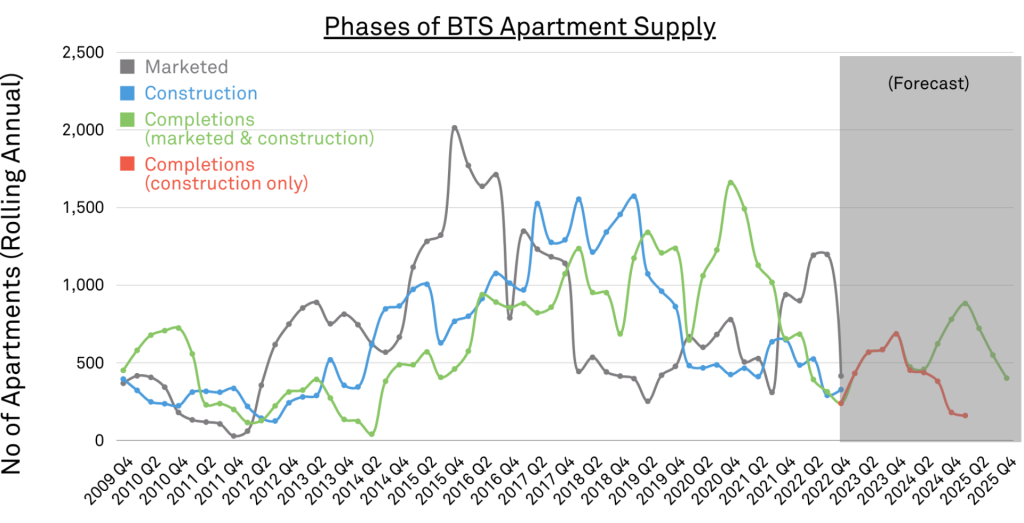

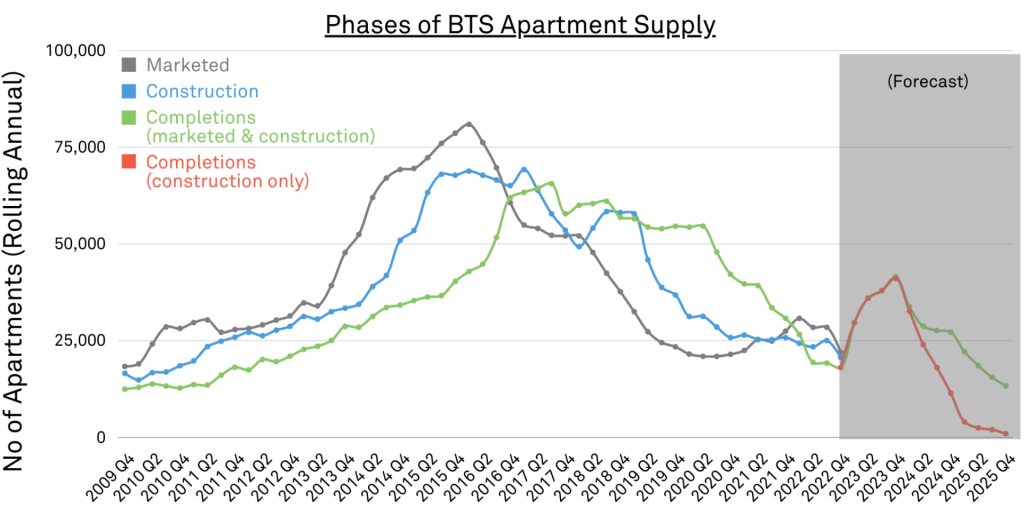

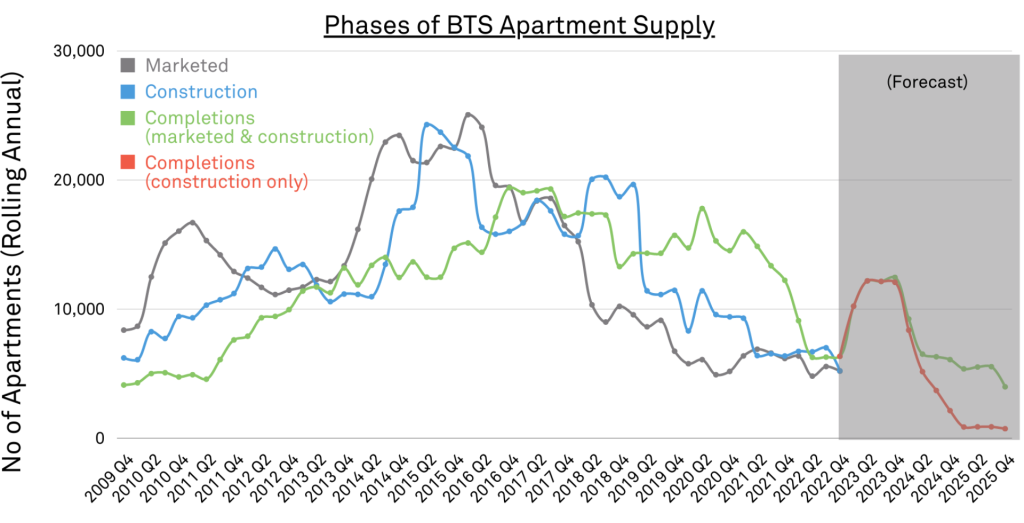

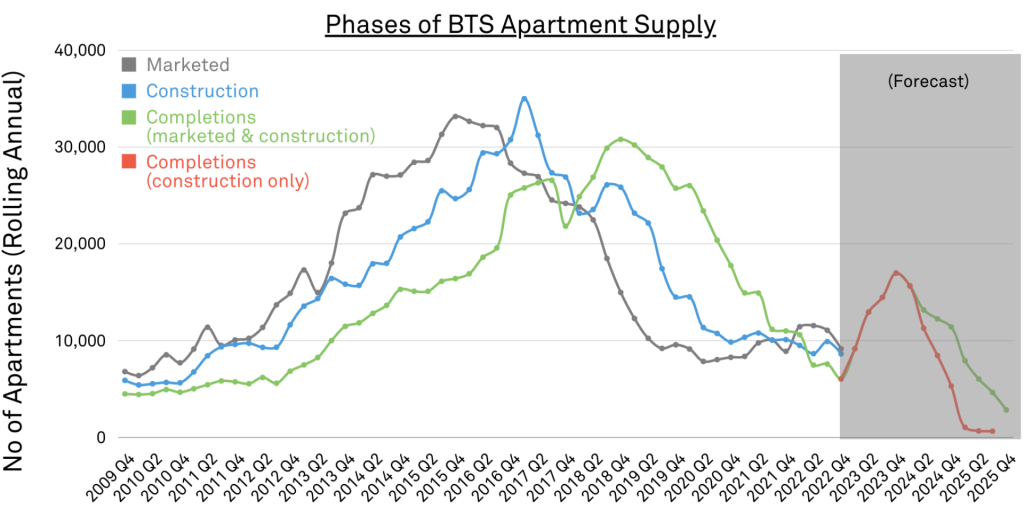

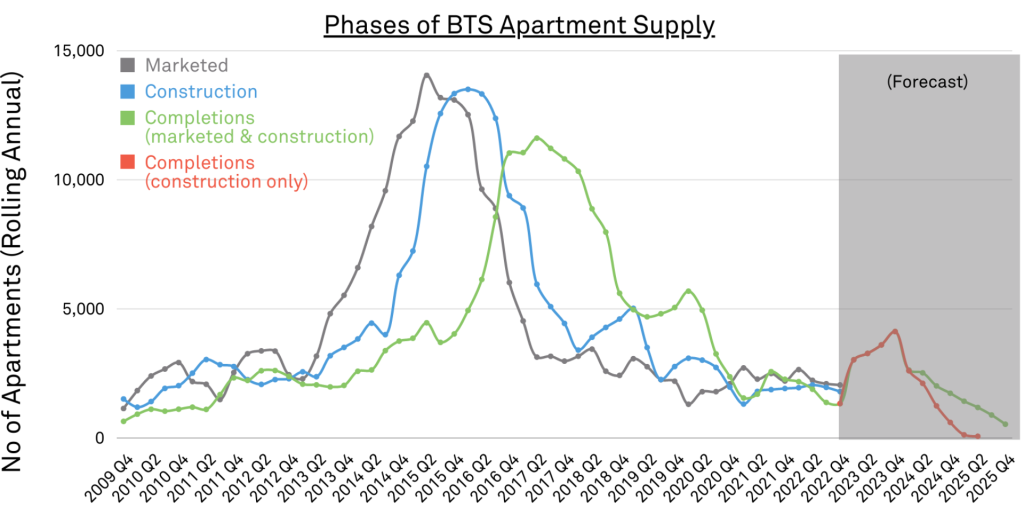

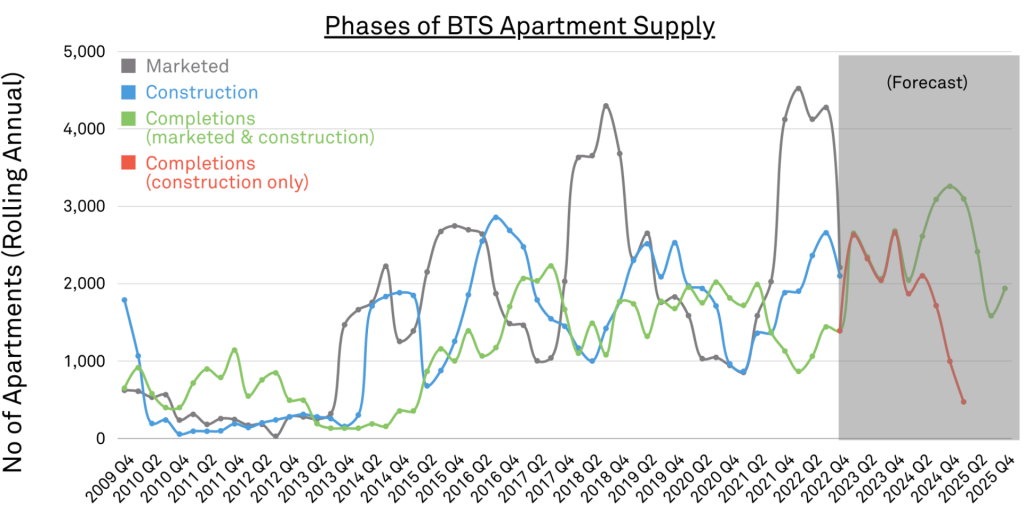

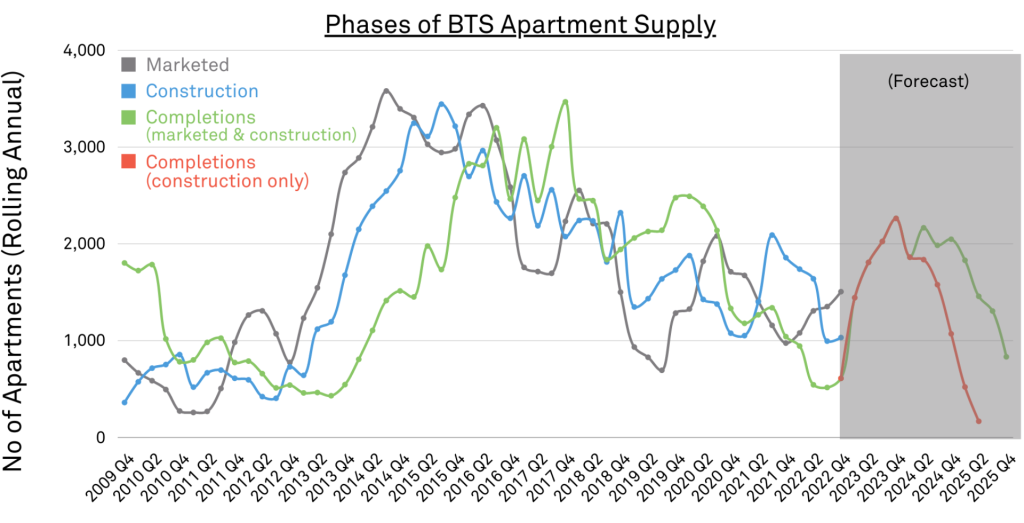

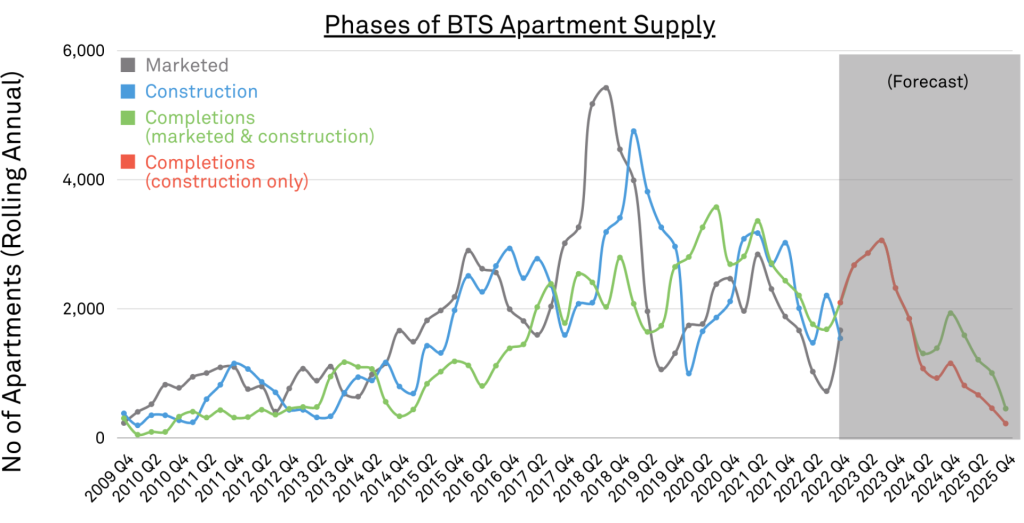

At Charter Keck Cramer we analyse the apartment market by looking at various distinct phases of supply in conjunction with each other. Specifically, these are:

- Apartments launched to market for sale (“Marketed” apartments). This is the first lead indictor of apartment supply. It is also a proxy for developer sentiment given that a developer will only launch a project to market when they are confident in obtaining purchaser (market) acceptance at the required price points.

- Apartments that have commenced construction (“Construction” of apartments). This is the second lead indicator of supply. It can be used as a proxy for both purchaser (market) acceptance and financer confidence in the product at the relevant price points given that the majority of apartment projects need a certain level of presales before they are able to obtain construction funding to proceed.

- Historic and short-term future apartment completions (“Completions – marketed and construction”). This is what has historically been delivered as well as what is currently under construction and being marketed. This is what is likely to be delivered in the short-term.

- Short-term future apartments that are under construction only (“Completions – under construction only”). This is a sub-set of the short-term future completions described above and have a much greater chance of being delivered given they have construction funding. This is one of several metrics that can be used to assess the relative risk in a market.

To gain an insight into where the market is likely to be in 2 to 4 years’ time, particular attention needs to be given to what is being released to market and what is obtaining construction funding. This can then be considered in the context of what is currently being completed.

The following charts show that the apartment markets across Australian cities are at various points in the current cycle. Whilst all markets are anticipated to see a COVID19 induced uptick in completions this year (due to the pandemic delays over 2020-21), many have been differently impacted by the pandemic; rising interest rates, increasing construction costs, buyer sentiment, interstate migration as well as the structural changes in living preferences (take up of apartment living and also renting).

These differences are best illustrated by comparing Melbourne to the Gold Coast:

- In Melbourne, both marketed apartments and those commencing construction are at the lowest levels since 2009. This is due to several factors including the loss of local and foreign investors, changes to investor lending, changes to incentives for investors, changes to planning controls and design standards, building defects, loss of occupier demand (from Net Overseas Migration (NOM)), increasing construction costs and rising interest rates.

- By way of comparison, developers on the Gold Coast have responded to the growing sea-changer (and mainly downsizer / rightsizer) market, part of which was expedited by the pandemic, and have launched a number of projects to the market.

Using the Charter Keck Cramer database, we can see it is typically taking a BTS apartment project of 75-100 apartments approximately 12 months from project launch to construction commencement, and a further 22 months from construction commencement to completion (conservatively 3 years). This means that projects launched today are at best likely to enter the market in 3 years’ time.

Across many of the capital cities of Australia there is going to be a shortage of supply of BTS apartments over the next 2 to 4 years. This is at a time when population growth, and in particular NOM is bouncing back very quickly.

The latest 2022 Population Statement prepared by the Australian Government now forecasts NOM to return to pre-COVID levels of 235,000 people in Australia over this financial year (FY23). Our view is that this is still a conservative estimate based on what is being analysed across various lead indicators with a more realistic figure likely to be closer to 300,000 people this financial year. In fact, given the announcement by the Chinese government last Saturday to ban its citizens from studying at foreign universities online, this figure has the potential to be even higher.

This mismatch between supply and demand will create significant opportunities (and also risks) for both the BTS and also Build to Rent (BTR) markets.

Australian Capital Cities

Melbourne

Sydney

Brisbane

Gold Coast

Perth

Canberra

Adelaide