1 November 2023

Unlocking opportunities in the Sydney mid-market commercial office market.

Over the last 12 months, rapid interest rate increases coupled with a change in workforce behaviour has caused a bifurcation in the commercial office market. Recent trends show that tenants and investors are seeking ‘prime’ office stock.

At present, there are a number of underutilised secondary and mid-market office buildings in Sydney. Many of these buildings have been substantially impacted due to the pandemic. At Charter Keck Cramer we observe that it is very difficult for ‘secondary’ commercial assets to attract tenants and as such investors are cautious about the income fundamentals of these assets, which is translating to an increased risk premium in the form of a softer yield. There is a dual effect of diminished cashflows and softening yields for some commercial assets, the effect of which is likely being masked by the very low volumes of stock being traded in this asset class.

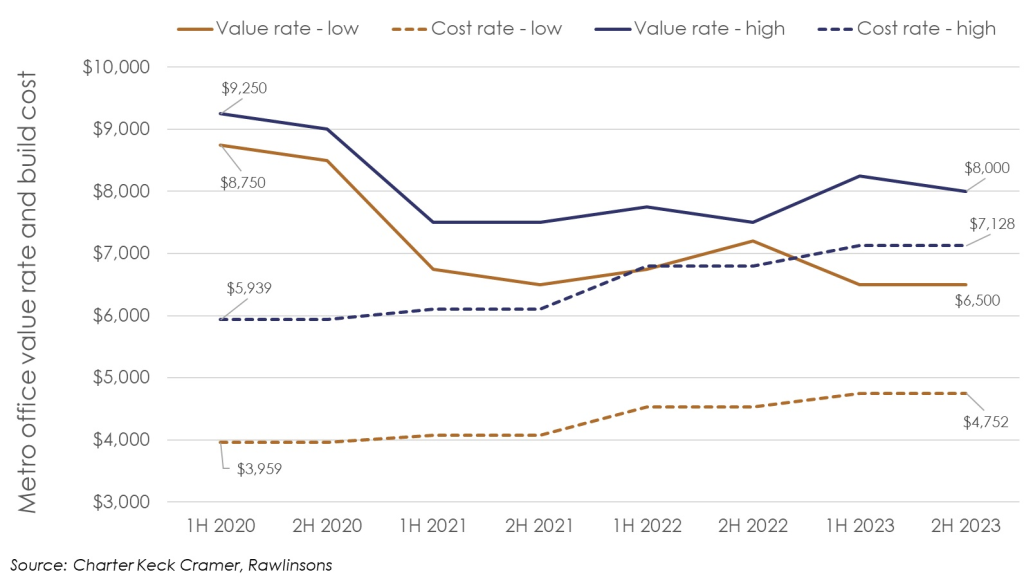

The cost of construction has increased markedly since mid-2020 which in some instances means that the capital value of these buildings is now at or below replacement cost. The chart below shows that the differential between replacement build cost and capital values in the ‘mid-market’ office space in Sydney has decreased, and in some instances reversed, with some assets trading at below replacement cost.

Sydney office value rates ($/sqm) and build costs ($/sqm)

There is an opportunity to refurbish ‘secondary’ or ‘mid-market’ offices into higher specification assets that more adequately meet tenants needs, or repurpose existing structures to hotel or residential uses in established urban centers/fringe CBD precincts/suburban locations, albeit noting that residential buy to sell apartments are notoriously difficult to create in commercial buildings.

From an ESG perspective, there is also an increasing focus elsewhere in the world on embodied carbon in commercial building structures. There is the potential for a purchaser to retrofit an obsolete commercial structure and reduce the carbon footprint that would otherwise have been incurred for a new structure.

From the landlord / investor perspective, there are several attractive features of a repurposing or refurbishing strategy which includes minimising construction costs and a higher degree of certainty around timing in order to deliver the product at a desired time to meet market demand.

From a future buyer perspective, funds and syndicates could also achieve higher returns (IRR hurdles).

We remind our readers however that this won’t work for every building and a detailed assessment is required before embarking upon such a strategy. At Charter Keck Cramer, we can provide support for both the advisory and valuation aspect of this matter. Get in touch with our team today.

Mark Willers | National Director